Do you know an American overseas? Make sure they understand FATCA! Put another way “did you know that you can be on the hook for thousands of dollars just to figure out whether you owe money to the IRS or not?”

Download the Infographic

Prefer to see the visual? Check the full FATCA infographic here. Or read on to enjoy the text version.

The Ugly Face Of FATCA

The Ugly Face of FACTA: Why Life for Overseas Americans Keeps Getting Harder

In 2011, THE IRS Introduced the Foreign Account Compliance Act, or FACTA. Designed to “minimize tax cheats”, FACTA is making banking- and life in general- painfully difficult for millions of American expats.

Under FACTA, all 8 million or so Americans living and working overseas must report all non-US financial accounts to the US government.(1)

The ambiguities and complexities of reporting under FACTA mean that many expats, most of whom are not wealthy, spend thousands of dollars every year to ensure that they are in compliance.

However, this is just the beginning of FACTA’s ugly impact…

If a bank does not agree to comply with FACTA’s stringent reporting standards, they are subject to a 30% tax on ALL US-sourced income.

Faced with this threat, “more than 77,000 financial institutions have agreed to pass information to the IRS.” (2)

However, rather than risk the consequences of accidental non-compliance, many banks are simply refusing to do business with Americans.

In a 2014 survey, nearly 13% of 6,552 Americans reported being unable to open an account because of FACTA. 1 in 6 reported having at least one account in a foreign bank or brokerage house closed. (4)

5.6% of survey respondents (6,552 total) even reported being denied a position in their company because of Facta. (5)

Rather than deal with FACTA, Americans are renouncing their US citizenship in record numbers.

In 2014, a record 3,415 individuals gave up US citizenship. (6)

That’s 15 times more people than did in 2008. (7)

Through the end of Q3 of 2015, 3,221 citizens have already renounced citizenship. (8)

FACTA is an unfortunate outgrowth of the United States’ policy of citizen-based taxation. Every other developed nation in the world practices residence-based taxation. In fact, Eritrea is the only other country in the world to practice citizen-based taxation. It ranks 174 out of 178 countries in the 2015 Index of Economic Freedom. (9)

Ironically, according to the 2015 Financial Secrecy Index, the US follows only Switzerland and Hong Kong as the best place in the world to hide money from other countries. (10)

Not an American? FACTA still affects you if:

-You share a joint bank account with a US spouse

-You hold a US green card

-You have a “substantial connection to the US”

And no matter your nationality, you are now required by all 77,000 FACTA-compliant institutions to fill out a FACTA form when applying for a new bank account.

Spread the Word about FATCA – Share this Infographic!

Or share on your social media:

The Ugly Face of FATCA, How Its Affecting Americans Abroad - An infographic by the team at Global From AsiaShare this Post

Reactions on Social Media

Here are some comments selected from social media in response to this:

From Barry (last name removed):

“The United States of America eats its young. Innocent unarmed people gunned down on a frequent basis because lawmakers are too cowardly to take action to limit guns on the streets; American citizens working abroad to support their families are subjected to onerous and unfair reporting and collection requirements in order for the IRS to collect minimal revenue because lawmakers are too cowardly to reform the tax code by taking away unneeded subsidies from big coal and big oil; misrepresentations and inaction on the part of politicians about the impact of climate change continue putting at risk future generations.”

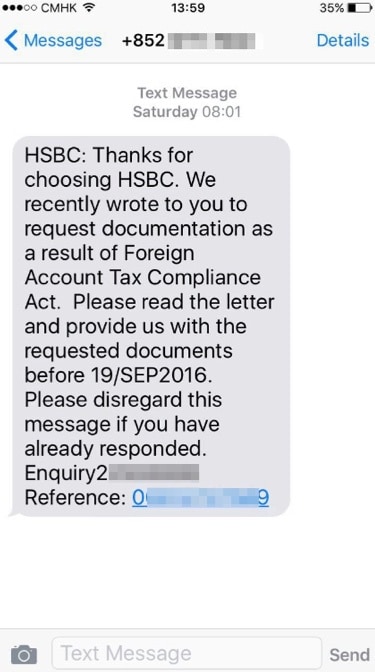

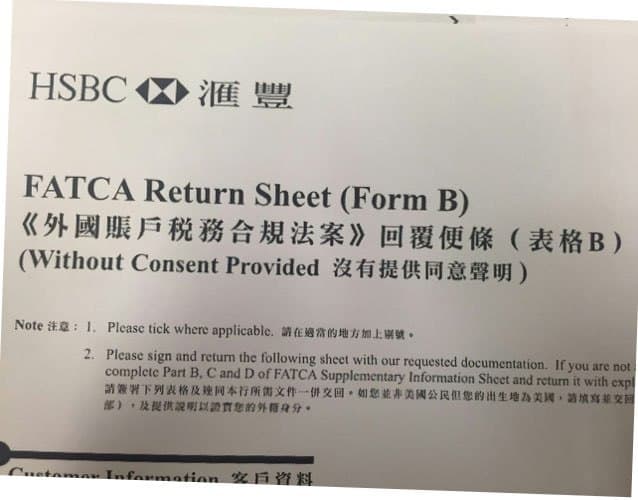

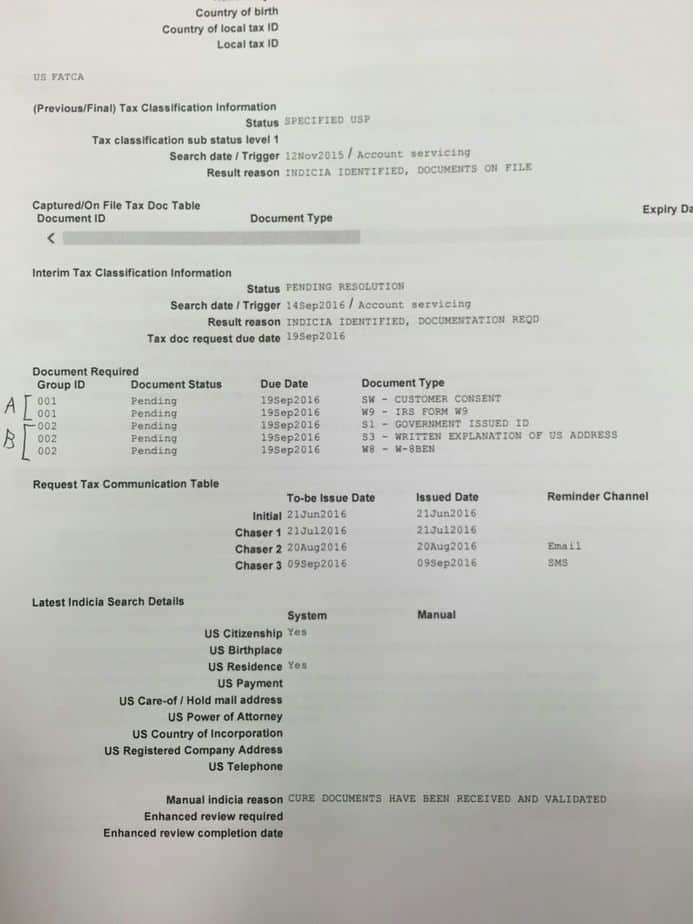

HSBC Hong Kong + FATCA

Thursday Sept 15, 2016. Seems the Hong Kong and other global banks are still adapting and adjusting to the FATCA regulations.

A friend of mine got this text message and is now in the HSBC bank handling it.

He says he complied with everything they asked him before – but now are asking for more things.

So he went into the branch. Even though he did it for his company accounts in the past – now it was also being brought up for his personal. He thought since its the same bank they would cross reference.

But he had to fill out forms. They are asking him to fill out a W-9 and a FATCA E

Seems they have a whole case on the FATCA filing for him as well. Imagine every client in the bank has one of these. All this extra paperwork.

Letter from German Bank Applicant

I just faced a questionnaire back in

Germany 2 months ago when I opened a bank account for my 12yr old son.We had to fill a Fatca form and they even asked for my Chinese tax number (which I

refused). The banker said, if I even own one share of a US company, my German bank is required to ammend my FATCA details and inform them –*as a GERMAN that is …. crazy..*M. from Shanghai

Pressure To President Trump on FATCA

The debate continues for getting rid of FATCA. Here are some great articles for further reading:

Forbes: Dear President Trump, Please Repeal FATCA

Forbes: Dear President Trump, why I’m leavig America

What Is FATCA (from a Facebook group)

So I am in a bunch of Expat Facebook groups, and this is a discussion in one that I couldn’t resist to share on the blog. This gives people a better idea of how it is really messing up American’s lives living abroad.

Hi all, I know that facta is a very hot topic here, but I don’t understand why. It appears to be a US law requiring that foreign bank accounts are reported. How does this cause us expats harm? Not trolling, just ignorant on this point. Thanks

– Facebook group question

Some foreign financial institutions (banks, brokers, wealth managers, mortgage companies etc) don’t particularly like the facta reporting idea, therefore, they prefer to have no US person accounts on their books any longer.

Like · Reply · 9 · February 2 at 12:14am

Well, as far as reporting goes, it sounds very simple. However, it has meant that the foreign banks have had to spend enormous amounts of money to 1 – find the US citizens and taxpayers among their customer base and 2 – program their systems to report….See More

Like · Reply · 12 · February 2 at 12:16am

Oh yes, as Brian reminds us, below, the penalties for the banks if they mis-report are terrifying: 30% withholding tax on all the bank’s investments in the US.

Like · Reply · 2 · February 2 at 12:19am

And a 30% withholding against income to the us citizens account. See my recent letter attached from Edward jones.

Like · Reply · February 2 at 6:56am

View more replies

I have lived, worked and paid German taxes here in Germany for over 40 years. Now, due to FATCA, I no longer even have a bank account. My bank decided it was easier to throw me out than to worry about making an error in FATCA reporting.

Like · Reply · 13 · February 2 at 12:17am · Edited

if I am correct, you have the right to an account according to German law. How can you get paid without one?

Like · Reply · February 2 at 1:18am

I only used the banking services of my investment bank, which no longer wanted me as a customer. These were the only accounts I had in my name. My wife has a bank account, that works for us. I’m sure I could get a “basic” account at a local bank, but I do not want to apply for one.

Like · Reply · 2 · February 2 at 1:24am

Actually the problem is not with citizens reporting their foreign bank accounts (that has been on the books some 30 years), but with the fact that foreign PRIVATE institutions are required to report to the US government on US citizens. How is this different from the laws under Hitler and Stalin when the neighbor had to spy on their neighbors? Are we now the UNITED SOVIETS of AVMERICA or is it HEIL MR. PRESIDENT?

Like · Reply · 12 · February 2 at 12:35am · Edited

Furthermore, FBAR and FATCA require a US citizen to report any account in which they have signature authority, such as THEIR EMPLOYER’s account, their FOREIGN SPOUSE account … and the US will not compensate the citizen for loss of job, law expenses for violation of the employer/employee non disclosure agreement, or divorce from the foreign spouse!

Like · Reply · 12 · February 2 at 12:39am

That part about the non-US spouse is the crux of it.

Like · Reply · February 2 at 3:07pm

Write a reply…

Thanks very much for these comments, the problem is much clearer to me now. I can see where this has the potential to really screw things up for individuals…

Like · Reply · 8 · February 2 at 12:43am

Dear I wish more people who didn’t know would ask like you did! Thanks for being interested and curious.

Like · Reply · 11 · February 2 at 1:15am

Also, imagine you didn’t know you had to do this until just now, because you were born in the us, are a citizen but are also a citizen of another country in which you have lived your whole life and been a good compliant tax paying citizen. You are bein…See More

Like · Reply · 6 · February 2 at 1:43am

View more replies

Write a reply…

I guess it varies between countries and institutions, we haven’t had any issues with this (yet), being expats and homeowners here.

Like · Reply · 1 · February 2 at 12:44am

I live in the UK and haven’t personally suffered harm. However, I don’t bank with a bank who has a US presence. And therein, I think, lies the difference. Touch wood, my bank will stay out of it.

Like · Reply · 1 · February 2 at 12:59am

I have had issues with the U.K. when attempting to open non-resident business accounts.

Like · Reply · 1 · February 2 at 1:16am

View more replies

Write a reply…

Yeah, imagine living in a place like Manila where kidnap for ransom is a problem. Last thing I want is some underpaid clerk at the bank collecting my personal data on orders of the IRS and then sharing it with corrupt underpaid banana republic government officials who have to review the data on order of the US Treasury IGA with the Philippines. Hell No!

Like · Reply · 9 · February 2 at 1:19am · Edited

Also. You have the part that says that ALL entities have to be categorised. (Financial Institution, Active NFFE, Passive FFE). USA requires financisl institutions to send letters to get self certification from (amongst) all entities with certain NACEco…See More

Like · Reply · 3 · February 2 at 1:25am · Edited

Happening in Canada too. Just got the letter for the first time after living her since I was 18. My bank is adamant I fill it out. How did they even know I was a us born citizen?

Like · Reply · February 2 at 1:50am

If you have showed your passport at some point, it’s in there. Or you have stated country of birth in some form to the bank.

Like · Reply · February 2 at 1:55am

View more replies

Write a reply…

Hi …I ran into problems. Many of us moved abroad as children in an era when Social Security numbers were not issued until you either had to sign up for the draft or were employed for the first time. We weren’t aware that we had an obligatio…See More

Like · Reply · 7 · February 2 at 3:05am · Edited

This is exactly my story. I do not have 15,000 sitting around now to pay all of this to exit. I need this money for my kids. Keith says to do nothing, yet my bank insists I fill out the w9, now! I will, and wait it out. They can’t squeeze blood out stone?

Like · Reply · February 2 at 1:54am

Everyone has a story and everyone’s story is different. Each person will need to decide how to move forward, weigh the posibilites of how this terrible law(s) will affected them, their families and in my case, my employer. I ALWAYS considered myself a …See More

Like · Reply · February 2 at 3:17am

View more replies

Write a reply…

And now. All Americans without social security number will not get an account in many countries. Banks are required to get TIN within 90 days of on-boarding. It can take up to 8 months to get social security number.

Like · Reply · 3 · February 2 at 1:51am

🙁

Like · Reply · February 2 at 2:55pm

Write a reply…

Hi Eric. Just imagine, that you have to file taxes in a language you were not educated in under the threat of massive penalties and under massive time pressure. When doing this, you find out, that you also have to report your parent’s accounts, as they…See More

Like · Reply · 6 · February 2 at 1:54am

Some banks in Panama have started to charge “Maintenance fees” of over 200.00 a year to pay for the paperwork. Being a US citizen and trying to get an account is nearly impossible because of the paperwork. We’ve had one for many years, so it hasn’t affected us, but some people had their accounts closed. They made us sign a W9. All money we have is earned at taxed at the source, but they don’t seem to believe it.

Like · Reply · 1 · February 2 at 3:23am

I am only aware of a couple of individuals being asked to sign the W9 where I am. However, my employer did get the letter for his trust accounts (some, but not all of the accounts) asking if he, any partners or anyone who could direct funds were US pe…See More

Like · Reply · February 2 at 3:29am

not anymore. Serious crackdown under way.

Like · Reply · February 2 at 4:40am

Write a reply…

Because the banks won’t accept American accounts, get rid of those they have, call in loans, including mortgages. In some cases people are denied jobs because the banks won’t let them have signatory rights which will be part of their job.Pension companies and insurance companies will deny Americans. Other than that there is no problem.

Like · Reply · 2 · February 2 at 3:51am

I’m trying to buy my dream house in France. Banks and mortgage loan people told me my American nationality would make it much more difficult because of Fatca – if not outright impossible.

Like · Reply · 1 · February 2 at 5:20am

The banks here in Hong Kong find it too expensive to spend man-hours singling out potential Americans for FATCA reporting, so they have been carpet-bombing every single one of their clients holding business accounts, forcing them to prove they have no …See More

Like · Reply · 2 · February 2 at 9:53am

USA is “holding the world hostage” over this.

Like · Reply · 3 · February 2 at 1:14pm

Write a reply…

How about foreign banks refusing accounts because of the reporting burden…..happened to me about 3 times already…..HSBC, CITI SINGAPORE, Kasikorn in Thailand

Like · Reply · 3 · February 2 at 11:27am

Many people I know received letters from their banks in Switzerland that their accounts would be closed within 3-5 days and few banks were taking new clients for them to open new accounts. Because the reporting requirements are so onerous for the banks…See More

Like · Reply · 3 · February 3 at 6:58am

…(5) years of tax return? That’s over reach! I thought it (W9) only had to be signed and reported by your bank, who then reported your government, who reported to the IRS. Is it different in Europe Keith Redmond ?

Like · Reply · February 3 at 11:55pm

I think Switzerland in particular was targeted since everyone has certain ideas in mind when they hear the words “Swiss bank account”. However there are no provisions for cases like mine: normal people living and working abroad who have US passports, o…See More

Like · Reply · February 5 at 8:50am

Write a reply…

Switzerland is a special case. Most places only require the W-9.

Like · Reply · 2 · February 3 at 11:57pm

I think it’s more that they started in Switzerland before other countries – I wouldn’t be surprised if this is the direction it will go for other countries in the future.

Like · Reply · February 5 at 8:52am

Write a reply…

Wow! I would not like my tax returns with all my personal info being passed around a bank in this day and age of identy theft!

Like · Reply · February 4 at 3:53am

No choice. Submit the tax returns, or lose your bank account.

Like · Reply · February 5 at 8:51am

Write a reply…

Another problem that hasn’t been discussed is privacy and disclosure. Australia, like many countries, had to amend their privacy laws to accomodate FATCA – but they did so goaded on by the business lobby that absolutely could not afford the FATCA 30% …See More

Like · Reply · 2 · February 4 at 10:53am · Edited

Why should a local be discriminated against due to their birthplace in order for them to export their privacy to a corrupt foreign nation? FATCA is a great law if one condemns human rights.

Like · Reply · 1 · February 4 at 2:50pm · Edited

You also have to consider that we Americans are all getting registered and handed to the authorities. Not so dangerous in Norway at the moment. But in certain countries it might be. It’s a gold mine for different countries intelligence services etc.

Like · Reply · 1 · February 4 at 2:48pm

Main problem. Not every country is Norway.

Like · Reply · February 4 at 3:31pm

I know. The problem in Norway is that the different government departments aren’t exactly great at cyber security. So hackers could possibly get hold of such information.

Like · Reply · February 4 at 3:54pm

Write a reply…

.the biggest percentage population that this affects is retired and limited income Americans residing overseas. Banks refuse to open accounts for us, our annual tax preparation bill is far more complicated and expensive …esp for those who get…See More

Like · Reply · 1 · February 4 at 4:02pm · Edited

Turn the tables around. Suppose you were a US bank, serving, say Chinese living in the US, and China passed a law requiring you to report the value of their citizen’s accounts to China, or you would lose the right to, say, buy Chinese goods at Walmart…See More

Like · Reply · 3 · 14 hrs

The root of the problem is citizen-based taxation (CBT). FATCA is an enforcement arm, but that in itself, while invasive of our privacy, is not the biggest problem.

Like · Reply · 2 · 9 hrs

Resources

- Wikipedia American diaspora

- The Economist: Americas New Tax Law Compliance

- Democrats Abroad (link no longer working – www.democratsabroad.org/sites/default/files/Executive Summary – Democrats Abroad 2014 FATCA Research Report_1.pdf )

- WSJ: Record number give up US citizenship

- http://conservativeread.com/record-number-of-americans-renounce-citizenship/ (link ofline)

- Heritage.org

- Financial Secrecy Org (link offline – financialsecrecyindex .com/introduction/fsi-2015-results

Infographic by Content Blossom.

How Has FATCA Affected You?

I’d love to hear from readers who it has affected you. Seems not only Americans, but anyone in the world now is affected. Bankers are asking if you are American, and often denying you a bank account if you are a US Citizen.

Those who aren’t have to pledge and sign they are not, and they have no US citizen business partners either. Seems scary.

I’d love to hear more from you, please leave a comment below.

Comments

15 Comments on “What is FATCA? [Infographic]”

-

Jacob 1984USA

In 2011, the United Nations Security Council passed a resolution condemning the collection by illegal means of the Eritrean ‘diaspora tax’, http://www.un.org/press/en/2011/sc10471.doc.htm

The Council also condemned Eritrea’s use of the “diaspora tax” on the Eritrean diaspora to destabilize the Horn of Africa region and to violate the sanctions regime, including by procuring arms and related materiel for transfer to armed opposition groups, and decided that Eritrea shall cease those practices. It further decided that Eritrea shall stop using extortion, threats of violence, fraud and other illicit means to collect taxes outside of Eritrea from its nationals or other individuals of Eritrean descent.

Same pollicy as the US, but the UN said nothing about the US

-

FATCA is the tool to enforce the immoral practice of “US place of birth taxation”. It’s unjust. It’s unfair. People do NOT choose where they were born!

-

Edmund John

FATCA forces private foreign companies to spy on their own customers for the benefit of the US government, without any compensation in terms of cost, and without any benefit to the foreign financial institution (FFI).

-

RAFREE

FATCA is causing a lot of personal issues in marriages and for the children of Americans abroad, it’s causing people to have to choose between their family and country of birth and these are not the “rich fat cats” this law claims it targets! The fallout and harm being caused are horrible!

-

Pingback: Belize or Hong Kong Company Structure?

-

Pingback: Stripe Launches Atlas - Future of Cloud Incorporations?

-

Pingback: Differences in Corporate Tax vs Personal Tax for International Entrepreneurs

-

Pingback: How To Renounce US Citizenship

-

Pingback: Will Amazon FBA Be Shutting Down Seller Accounts for Foreigners in China?

-

Pingback: Is It Still Safe To Do Business in/with Hong Kong? (Plus Mike’s Journey)

-

HOMEiA

Same pollicy as the US, but the UN said nothing about the US

-

double standards can be annoying….

-

-

Pingback: Making Business Sense of The National Security Law in Hong Kong with Tariq Dennison