Once you understand how things work in Thailand, getting yourself a Thailand Tax Identification Number (TIN) isn’t all that difficult.

In this guide I’ll show you how to get your very own Thailand Tax Identification Number in under an hour.

Documents required to obtain a Tax Identification Number

To apply for a TIN you’ll need to show the following documents at the tax office:

- Valid passport with a valid visa or visa exemption

- Lease agreement of six months or greater, including a copy of the landlord’s ID

- Proof that you have spent at least 180 days of the last 365 days in Thailand (past entry stamps on passport)

Technically, you don’t need to have spent at least 180 days of the last 365 in Thailand to obtain a TIN. If you haven’t spent 180 days of the last 365 in Thailand but have a potential tax liability, the tax office will ask for further documentation as proof, such as a letter of intent to buy a condo or proof of investment if you’re expected to receive dividends.

If you cannot supply sufficient proof, then you’ll have be in Thailand for 180 days to qualify.

Tax Identification Number

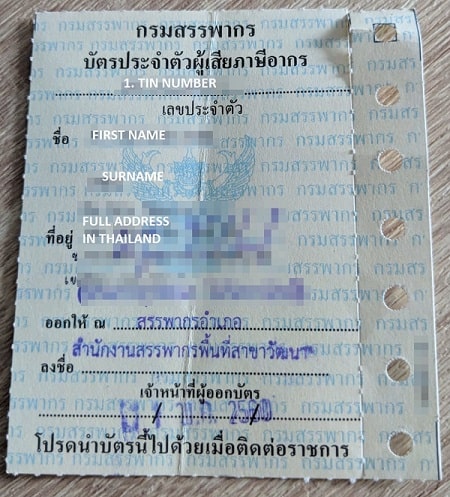

Above is what your TIN will look like courtesy of Harvie digital nomad who A Farang Abroad. It’s a small piece of card that contains your ID number (1), your full name (2), and your location (3). It will be stamped and signed by the tax officer who assigned you your TIN.

Once you have your card, double check your name and address is written correctly.

Like most things in Thailand (and Asia for that matter), nothing is black and white. If you apply for a TIN and you only have 10 days left on your lease agreement or 5 days left before your visa expires, you may be denied.

When applying, give yourself the best possible chance of success and ensure you have at least 30 days left on your visa before it expires and 3 months or more on your lease agreement.

All your documents must be originals and not photocopies. You will not be able to acquire a TIN with copied documents.

In Thailand most lease agreements come with a photo ID of the landlord, which they have singed. If you do not have this, simply contact your landlord and tell them you’re wanting to set up a TIN and need them to send you an A4 piece of paper with their ID and signature.

Which tax office should you visit in Thailand?

The tax office you visit depends on where your rented apartment is located. For example, if you’re staying in Chiang Mai, you cannot apply for your TIN in Bangkok or Phuket.

Thankfully the Tax Office of the Revenant Department in Thailand have a somewhat useful map of which office you need to visit based on where you’re staying.

Bangkok has over a dozen offices. If you’re unsure which branch to visit, the link above provides telephone numbers to all tax offices. Simply tell them where you’re staying and they will point you to the right one.

How to apply

Once you have all the documents ready and have found the relevant tax office, just turn up with your papers and it should not take more than an hour.

When I applied for my TIN, I did so at the Asoke tax office in Bangkok. Upon arrival, there is a desk where you tell them why you’re coming in and are assigned a ticket number.

Simply wait for your ticket number to be called and approach the desk.

Asoke is one of the most expat-dense areas of Bangkok, yet nobody at the tax office spoke English (I was the only foreigner in there).

I told them I would like to apply for a TIN, but that got me nowhere because of my lack of Thai.

I returned the next day with a Thai friend.

She helped me explain what I needed and helped me fill out the form.

The form you’ll need is L.P. 10.1 (individual). It cannot be found online (I did ask them if I could take one home with me, but they said it was not allowed).

This form is in Thai, so if you’re unable to read Thai I strongly suggest you bring a Thai friend to help you or hire an translator for a few hours to help you fill out the form.

As I did not have a work permit, they briefly questioned why I needed a TIN. I told them that I’ve been living in Thailand for over 180 days and bring income into the country which I need to pay tax on.

No further questions were asked and within 30 minutes I was presented with my own TIN.

There is no fee to obtain a TIN – it’s FREE.

If you’re pressed further about how you make your income, which is fairly common, avoid mentioning Bitcoin, trading, or anything else that may trigger alarm bells.

Pro tip: Avoid visiting the tax office on a Monday or Friday as these are the busiest days due to weekends being closed. The tax office is closed on Thai holidays so double check before going in.

Tips to help you get a TIN

When applying for your TIN, dress up smart and be clean shaven. If you’ve ever done business in Asia, you’ll know the way you dress is important.

If you have all the right documentation and you’re still being turned away because they demand more paperwork, such as a work permit, then in a calm and friendly manner ask if you can speak to the manager of the branch.

You do not need a work permit to apply for a TIN, just the documents I stated above.

It is common for employees working at the tax office to not know the full ins and outs of what is required, as most foreigners who apply for a TIN are usually working in Thailand and have a work permit.

To minimize friction, take a Thai friend or hire a translator and ask them to call the office beforehand asking for the required documents. Tell your friend to take the person’s name of who they spoke to on the phone.

This way, if any issues arise you can ask to speak to the person on the phone who guided you. This is a strategy I use when dealing with any type of visa, banking, or tax-related issues in Thailand.

When to pay taxes and where to find a good accountant

Each Thai tax year starts from January 1st to December 31st.

You must provide an income tax return to your local tax office before the March 31st for the previous year. Any payments made after that date are subject to fines.

I personally don’t have any accountants to recommend, but I would strongly advise you talk to at least five different accountants before making your choice. Some charge exorbitant rates because you’re a foreigner, so it’s best to work with someone who has experience with foreign workers or western-run businesses in Thailand.

Excerpt: In this guide learn how to get a Thailand Tax Identification Number (TIN) without needing a work permit.

Find out about the right documents you need and the process for getting your TIN in under two hours.

Questions from the readers

This section will be dedicated to those who have questions about Thailand Tax IDs. We will try our very best to answer all of them.

Here’s one from a Thai reader answered by another reader:

Question:

How do I find out my Thailand Tax ID?Answer:

Hi Michael,Not sure what this person wants. But in case he wants to know his TAX ID, it is his national ID number (the one with 13 digits) since he’s Thai.

Thanks,

Saran

Question:

Do I need income before applying?Answer:

No, you do not need income before applying for a Tax ID/

Looking for Connections in Thailand?

Connect with our specialists to see how to best help you on your business and tax journey in Thailand.

Get the Process Started For Thailand Assistance