Podcast: Play in new window | Download

Subscribe: RSS

As a Hong Kong business owner, accepting credit cards online is a crucial piece! Hong Kong has very limited options for accepting credit cards online, and many are very old fashioned and hard to use – especially in many of our e-commerce websites and technology startups!Stripe is so easy to use, and it was built by developers, for developers!

We beg Stripe to work on accepting Hong Kong companies, and are starting this petition to start to show and build interest in the community!

Update Since This Post Went Live

We made this podcast back in early 2014 before Stripe was in Asia. They are in Hong Kong and Singapore now, and we hope this podcast was a part of making that a reality!

Update July 10, 2017

Stripe is “officially” live – and announced it during Rise conference in Hong Kong. I was lucky enough to be there, and wrote up Stripe’s official go-live.

Update Nov 10, 2015

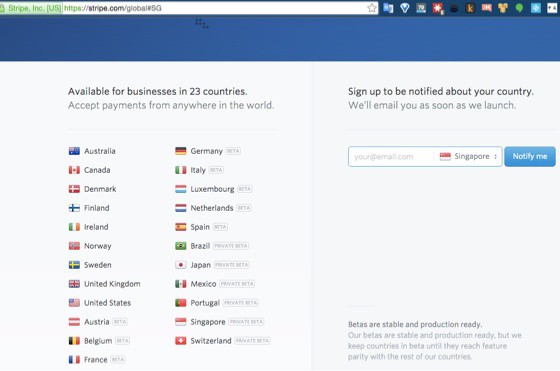

So I just got confirmation friends in Singapore are getting private invites to Stripe in Singapore. Checking the Stripe global page, Singapore is listed there. Tech in Asia heard rumors and it took a few months. Based on Stripe’s chat at Rise Conference in Hong Kong, they are coming soon, believe if they are in Singapore, they are soon to be in Hong Kong!

I wrote up an article on Stripe in Singapore, Hong Kong Next?

Original Post

Petition Link: http://www.thepetitionsite.com/482/986/964/we-need-stripe-merchant-account-services-in-hong-kong/

Stripe’s Global website where you can also request: https://stripe.com/global

Topics Covered in this Episode

- The current merchant account options for Hong Kong companies and why we need to wait for Stripe!

- Asiapay – I have interviewed Asiapay (Jo Chan episode 16), and they have an application fee of about 3,000 Hong Kong dollars – so this is a big stumbling block for many small to medium sized businesses. Its a pretty high processing rate – but I think Hong Kong businesses are used to that. What I didn’t discover until after the show is that when checking out online, you are re-directed to their AsiaPay secure checkout page when a customer chooses to pay by credit card. For e-commerce businesses, this is a big user experience issue – many tech companies want to keep the flow on their own website to ensure the quality of the checkout is smooth and no interruptions or “fear” is created. Going to an asia based website to put in a credit card, for a US or European person, may get a bit scary!

- Worldpay – I am trying to arrange an interview with them – some people I have interviewed on this show use Worldpay (Marshall on Episode 6) but there is also a pretty high application fee and at least 1 month time to open the account. He has also told me that a lot of his transactions get declined from customers for unknown reasons. I know he is very anxious to have Stripe come to Hong Kong.

- Paypal – the default payment that many I have interviewed use in Hong Kong. It is free and easy to open – but the exchange rates are pretty steep. I also have had account freeze issues, and a good friend of mine (name I won’t disclose) finally got his PayPal un-frozen after about a week and a half. Its also not able to use credit cards (customer has to have a credit card), well they can use a credit card 1 time, but the second time that customer tries to use that credit card, they have to open a Paypal account. Update, I have recently written the Full Guide to Paypal for Hong Kong, read and enjoy!

- Paypal Pro– This is a good solution for accepting credit cards and having it settle in your PayPal balance. Years ago I tried to open this service in my Hong Kong Paypal but it was only available in USA and UK based Paypal accounts. After some research, I see its now offered in Hong Kong and am looking into it.

- 2Checkout – In a business many years ago I was using it and withdrawing money to my HSBC Hong Kong account. For my latest venture, Social Agent, I went there to apply, read the documentation, and applied. They require a 15 USD application fee which I had no problem paying – but within 5 minutes of applying I received a system generated email that my application was denied because my business is based in Hong Kong and they do not support Hong Kong companies. I have no problem if they decide to do this -but they system should have detected that I selected Hong Kong in their drop down menu on the online form, and immediately told me not to spend the 15 dollars as I would automatically be denied. They refused to credit my the 15 dollar fee and I will never do business with them again.

- Bitcoin – I’ll do a podcast next week about bit coin – but of course this is still a very early stage technology and not widely accepted as a payment method. So not a viable offer as a main way to accept credit card payments from online customers.

- From my experience, most online e-commerce businesses in Hong Kong solely rely on Paypal.

- Comparing to other Country’s Current Options

- China company – Obviously a lot of people, so a lot of options. There is a multitude of domestic merchant solutions, and they also offer quite a lot of “high risk” merchant accounts for overseas / cross border businesses.

- USA company – Obviously a huge population too, and deemed to be the lowest risk country when applying to banks.

- Hong Kong market – sure its not big – domestically – but as we have covered in previous podcasts, there are tons of businesses that have overseas businesses that use Hong Kong as their headquarters. I was told 7 million registered Limited companies (discussed with Sunny Wong on Episode 2), and I’m sure a ton of them accept online payments via commerce or telephone from international customers!

- Limited functionality in HK based merchants makes Hong Kong look less advanced – There are some major businesses in Hong Kong that when you checkout, you are redirected to Asiapay, or Paypal. This is embarrassing as a “tech dude” in Asia. I believe this is why the West discounts Asian tech companies, because these user experiences. Upgrading the payment gateways is a big user experience improvement on the Hong Kong tech scene!

- So what do people do now who want Stripe in Hong Kong? I know some have US or Canadian companies for the sole reason to have a Stripe (or other) merchant account. This is more complicated accounting and more yearly fees for taxes and filing services.

- Stripe may have to Modify its Offering to localize in Hong Kong – sure, they may have to charge an application fee in Hong Kong, and charge maybe a higher rate. I believe most people would still accept that. We want stripe because its EASY to USE! It is easy to integrate in our online businesses, it is built by developers for developers.

People / Companies / Resources Mentioned in this Episode

- Stripe

- Paypal Hong Kong

- Paypal Pro in Hong Kong –

https://www.paypal.com/hk/cgi-bin/webscr?cmd=_wp-pro-overview-outside

https://www.paypal.com/hk/webapps/mpp/compare-business-products

paypalobjects .com/webstatic/en_HK/developer/docs/pdf/hostedsolution_hk.pdf (no longer working)

https://www.paypal-marketing.com.hk/en/business/website-payment-pro.php - AsiaPay

- Worldpay

- 2Checkout

- Bitcoin – check Wikipedia (Bitcoin definition on Wiki, or next week’s Global From Asia episode!)

Episode Length: 16:49

So if you’re one of the many Hong Kong based businesses who are begging for Stripe, please fill out our petition below and let’s show the numbers!

http://www.thepetitionsite.com/482/986/964/we-need-stripe-merchant-account-services-in-hong-kong/

Announcement: I mentioned on previous episodes there is going to be a “Hong Kong” podfest – April 12, 2014 at Les Boules in Sheung Wan on Saturday. It will be from noon til 8pm, I should be on stage from 2 to 3pm – you can get up to date ideas from PodToThePeople.com (offline now).

Download Options

- Direct Download: Right-click here and click “Save As” for a direct download

- iTunes: Listen and subscribe on iTunes for free!

- Android: Listen via Stitcher Internet Radio streaming

- If you enjoyed this episode, leave a positive review on iTunes!

Leave A Review for Stripe Merchant Account Services

Now it’s your turn to share – what is your rating for Stripe Merchant Account Services.

Podcast Transcription

Mike: Thank you for tuning into another episode of global from Asia we are at Episode twenty six and as a bit doing these weekly twenty six weeks is six months so it’s a six month birthday for global from Asia connect with so many great people and built stronger relationships with business people I know around the world and it’s keep me excited each week to release another show so thanks for listening out there another announcement is it’s my birthday April second be thirty three years old so now it seems like my podcast is a half a year and I’m thirty three it’s been an amazing year this past year this podcast and my business social agent and other amazing personal things was marriage and baby in Spain amazing year so even if next year is half of his what this year has been is going to be mind blowing so Today show is a bit special I’m going to do it on my own and I’m just going to jump right into topics so as a whole called business owner I do all my up business online remotely accepting credit cards is a very critical piece and unfortunately Hong Kong still has very limited options for accepting credit cards online and some are very old fashioned and hard to use especially when we want to integrate them in our e-commerce websites and tech startups so. Ahh we’re talking about stripe and stripe dot com is kind of a new it’s only a few years old it started out so a convoy and it’s not paid by them I have no connection with this company I just love to use it and it’s very easy to use it’s built by developers for developers it’s very easy to integrate with websites and payments very easy and the payment the setup is easy so. My my other team members and other companies I know in Hong Kong are always asking about it so it’s currently not available for Hong Kong companies they are going around the world now they of course started in the U.S. but they went to going through Europe and they’re opening in many countries around the world so where. We’ve been going on a waiting list you can fill out a form on stripe dot com slash global and put your e-mail address for notifications I did maybe six six months ago or so and I still haven’t gotten any any notice so I just thought that today would be a great great time to bring that up. This kind of started from a start up a Facebook page people are asking about a stripe in Hong Kong or other solutions and I keep seeing people always asking about about this. And we still don’t have a have a here are an easier solution and part of this podcast has been making it easier for people to do business in Hong Kong internationally so payment is a huge part of that I did start a petition online just a free petition website you can find a direct link on a show notes global from Asia dot com slash episode twenty six so I’d really appreciate it if you took the time to fill that out if you’re interested in and in submitting your name in going in with this campaign so I think while while we await for us to write by I just want to be explain what people are doing now to accept credit cards online in Hong Kong so we. We start with PayPal and Pay Pal You know I think globally has done an amazing job you know they they make it pretty easy for people open up accounts anywhere in the world and to receive money but it’s not really built for a credit card you have to have a PayPal account and they make both sides kind of happy Pal accounts I know that the customer can use your credit card one time on PayPal dot com to send money too. A paypal merchant but that’s only one time if they try to do that twice it’ll say you already use your credit card and you have a create an account now so it’s not really if it forces all spalls sized happy Pal accounts so it’s not the most. You know Widely used Still I know people everywhere in the world but a lot of people still use like to use their Visa Master Card discover Amex card directly so they don’t want to get funds and PayPal. So there is a paypal pro ahm Honestly I learned this when I was researching this podcast that when I first start looking for people pro people pro you can accept credit cards and can accept an A in a shopping cart without going to People dot com and without the customer needing a Paypal account and it has these credit card. Ahm When I try to do this a couple years ago it wasn’t yet available in Hong Kong it was only U.S. and U.K. companies but now it does seem available so I will put that link on the show notes too in the paper prosecution for people who want to direct link to the Hong Kong people pro So that’s one one solution people use Paypal or Paypal pro Asia pay I did interview them on Episode sixteen they seem to be kind of the local choice they have an application fee of about three thousand or so Hong Kong dollars. Which is a upfront fee guaranteeing to have an account that goes through and they. They will you know decide in your risk factor of your company so you know I think that is a kind of a big stumbling block for small to medium sized businesses to pay. Ahm There is a higher processing rate you know I I think even if stripe comes to Hong Kong they’re going to have a higher rate because there is higher risk so I’m not really going to put that against them.But one thing I didn’t realize until after the show is some of my listeners brought up that when you check out with Asia pay a credit card on a shopping cart it redirects you to Asia pay. Dot com So it’s like a secure checkout with your Visa credit card number and you know CD code and expiration date address so so so say you’re buying something on your shopping cart or your website and then it’s a customer picks credit card have to go to Asia pay dot com So you know I think this is a little bit not ideal I think this especially if the U.S. or European customer they have to go to Asia pay Web site with a kind of like Asian characters I think that doesn’t really make a lot of international customers feel maybe secure with putting their credit card number so I feel that I might not. Always get the best conversion rate for for those e-commerce guys out there so another one we have is world pay I’m actually trying to get them on the show going to a couple different contacts to get them on the show so a lot of people I talk to do use them they kind of are the global international higher high risk merchant account so when I say high risk you know I think that means like offshore companies you know Hong Kong is considered I guess hot off shore so they they’re more willing to work with these kind of higher risk merchants Marshall Marshall topless we interviewed on episode six he’s using them you know you have to pay another higher application fee I think a few thousand Hong Kong dollars like to pay and also go through some you know pretty pretty extensive background checks credit checks.To to get the account open. Another thing that Marshall just mentioned to me was some of his transactions get declined for not really a good reason from customers and customers are really e-mailing him saying I tried to check out her card in go through so I know he’s very excited or anxious to have stripe come to Hong Kong and he’s a really tech tech guy to an interest stripe is very easy for tech people integrate with their shopping carts so. So those are the choices I do want to bring. Up a couple more that I’ve researched I used to use to check out dot com which isn’t really a merchant account it’s kind of like a alternative solution so they’ll accept the money for you and then they’ll debit it out to you but they receive it as a merchant and then they send it to you so they really want to make that clear but unfortunately no longer support Hong Kong based companies. Maybe in two thousand and eight two thousand and nine in a previous internet company I was working with we had to check out account and was able to connect to my H.S.B.C. Hong Kong and debit there in dollars which is very convenient but unfortunately they don’t support that anymore I don’t know their reasons I did reapply in my current business to get there. To Get an account and their on line form was pretty easy I filled out all my information and I’m in Hong Kong company and eccentric stature and then I paid fifteen dollar like fee for applications not a lot of money but within five minutes I got an auto response that they don’t support or they don’t know except Hong Kong companies and they denied me so I replied to them I said couldn’t you have told me that before I applied I mean you saw when I fill out my application said Hong Kong and they didn’t seem to really. Seem to really be concerned and you know it’s only fifteen dollars but I would have expression to them to refund me if it was an automatic three Jack based on my country when I filled out my country anyway I’m never going to use them again. The next one is bitcoin Bitcoin I’ll do a podcast next week to give some people some insights it’s very early technology in a very kind of volatile so it’s not really an accepted painted method for the normal wide you know range of audience of customers so I don’t really think this is a primary way to receive payments from customers and maybe you can put this on your site but obviously it’s not going to replay. Visa and Mastercard credit card transactions so those are the ones that I’ve I’ve researched and I’ve talked to people about for people in Hong Kong. You know them well let’s next talk about you know other countries you know. China right next door to Hong Kong they obviously have a lot of people a big population so they have their own like kind of banks in their own their own like payment solutions and merchant accounts and and everything so you can do that domestically and then also for their international They have a few different high risk merchant accounts with also their higher application fees and they’re a little bit higher expensive but there are a lot of different choices so just to give some people some ideas of. China I’m not going on to details and then of course in America is a big highly populated country and you know banks seem to deem it a very low risk country for issuing credit and so those callow processing rates and you know you have a lot of choices I am american you know I’d like I could easily you know have a U.S. company U.S. merchant account but I I live and do business overseas and my my funds are coming in and out of Hong Kong and Asia so. Me Like many of others living overseas you know going through a U.S. company and U.S. bank is just extra extra money and extra fees and delays and your cash flow. So when we come to Hong Kong right Hong Kong of course it’s not a big population domestically I think there’s fifteen million people and so maybe some companies think that’s too small of a population but we’ve gone in all their pod casts really sunny Wong told me there is about seven million registered limited companies in Hong Kong and of course that means fifty percent of the population is got a limited company but of course that’s not true a lot of people live offshore so seven million companies low. Media companies and a lot of those guys are doing business around the world internationally I know people you know they have home companies based in Thailand based in China based in you know Canada all over the world so they they would definitely anxious to have better merchant account solutions for their Hong Kong based company so you know I think sometimes maybe stripe or maybe other guys still look at Europe or U.S. or other other populations as a bigger market but you know I think they’ve got to realize that there’s seven million limited companies approximately and. They’re all very anxious and willing to use a merchant account that is a little bit more friendly for tech technology and e-commerce so you know I think also with the current limited Hong Kong merchants it does make Hong Kong look a little bit less advanced technique technologically. Sort of business in Hong Kong there when you check out your redirected to Asia pay or Pay Pal and these are pretty major like major companies I’m not going to schools which ones but you know I think that’s a bad user experience and still a bit embarrassing for me as a tech dude in the Asia that there’s the still like kind of archaic old fashioned ways of doing e-commerce from pretty large institutions so you know I think for Hong Kong to improve its image as a technology center we as a community should work on improving Z. merchants accounts and user experience of customers doing business with companies based in Hong Kong. And now we’re going to the next topic. So what people do that really want stripe that are in Hong Kong you know I think basically what I know is people open up have U.S. companies or Canadian companies or other countries where stripe is accepted and they actually have a company for the sole purpose of accepting credit cards in those countries so sure I mean that that’s something. Possible but it makes more complicated accounting more more difficult business cash flows and wire transfers from like that country to Hong Kong to pay or maybe your Hong Kong credit card or your Hong Kong bills or your payroll so you know that’s just another complication in delay so you know The next topic is maybe stripe will have to change its offering to localize in Hong Kong and sure I think that’s acceptable I we’re all used to paying higher processing rates and exchange rates to do business here and I don’t think the community will mind if there’s an application fee or there’s higher per processing rates I believe that people just want a more techno tech so technically friendly merchant account is easier to use and easy to integrate in a shopping car and control your user experience more so you know I don’t think it’s just about saving the money I think it’s also about integrating with year with your technology and we want to have better e-commerce and technology in Hong Kong based companies. So that’s that’s all I Have for today really I mean I kind of want to go through what current options there are what people are doing you know I know maybe Hong Kong is a higher risk place for for banks and financial institutions but it is a financial center of Asia and it’s just seems baffling to me that this is still so far behind in my opinion from Western financial banking solutions so so.Please go to our. Show notes on global from Asia dot com slash episode twenty six there’s a link to the online petition so that we can just keep track of how many numbers are I have a friend who will send this along to some people you know. Stripe I’ll try to send this over to stripe later and if A then we get some hope to get a response of their plans or the reasons why they’re not here yet. I’m definitely curious I I maybe I wonder if there’s regulations I just want to know maybe more reasons why it may be naive astride me readers other solutions or maybe a current providers here can make it a little bit easier for these online e-commerce companies to do business so. You know I hope I hope this makes some difference and thanks for tuning in.

69 Comments on “Hong Kong Needs Stripe Merchant Account Services”

Hey Mike,

Was just googling “Stripe in HK” and found your site. Didn’t realize you launched a podcast =)

Another interesting link:

https://gist.github.com/joeybeninghove/5421015

Anyways, I just subscribed and I’m about to listen to this episode.

(catching up w/ comments after being up in Chengdu with limited internet)

thanks David – glad you found my podcast – ya I mentioned it when I launched in Dynamite Circle end of October – been a bit shy to push it too much I guess! 😉

Thanks for this list – I am compiling a ton of options for an ongoing analysis and comparison.

Hope you enjoyed this podcast – feedback welcome – both positive and negative!

this episode i did it solo – normally I am interviewing people

Yeah the episode was great. I also listened to the episode about Worldpay, good stuff.

Quick questions (let me know if there’s an episode about this):

1. How much bureaucracy is involved in running a HK corp? I guess accounting + audits are the bulk of it?

2. A friend’s HK corp got audited and the company doing the audit told him that he’ll have to print out all of his receipts (40k pieces of paper!). Is that normal? Sounds like a pretty bad level of bureaucracy.

Not covered yet but good episode topic! I literally just setup voicemail recording via GlobalfromAsia.Com/voicemail and would rock if you could leave a message and be the first caller on the podcast!!!!

Pingback: Opening a Hong Kong Merchant Account with Jo Chan from Asiapay

Mike, any thoughts on Paymentwall?

Hi Jack,

Honestly never heard of them. I’ll look into it, any insights on your side to share ?

Hey Mike,

I’ve read some favorable reviews and their rates for processing CC payments seem on par with those of Stripe — 2.9% +.30 / transaction and no set-up fees, etc. However, it’s primarily designed for selling SAAS, recurring subscriptions, or digital coins ie dating sites and gaming.

They also have another service for being able to accept myriad alternative payment methods for different local markets (in 200+ countries and 25+ languages).

The only downside I can see is that they’re really not set up to handle payments for physical goods, as the CEO states in one of the links down below. Perhaps there’s a creative solution or software combination that would solve that issue?

Here’s a link to Paymentwall website:

http://www.paymentwall.com

Here’s a link to what the company CEO says on Quora:

http://www.quora.com/Which-is-the-best-payment-gateway-with-API-Braintree-Paymill-or-Paymentwall

They seem eager to interact with customers and make their product known. Although they don’t seem to have a HK office, they are incorporated there. Maybe you could reach out to them for an interview.

Wow,

This sounds too good to be true 🙂

Sure let me reach out to him for an interview for sure

Awesome, hopefully you can make that happen!

And great work with your show, really enjoying and learning from your podcasts 🙂

Thanks Jack,

Really happy to hear you enjoy the podcast and are learning

It’s been now over 40 shows and still a bit quiet on the feedback side, my first podcast so still learning how to make it more interesting and interactive

I can give you a shout out on an upcoming show! 🙂

Yea, but I think that’s understandable for something that’s just getting going.. as Chinese speakers always say to me in regards to learning Chinese “慢慢來”. Besides, the most important thing is that you’ve got a lot of solid content!

Thanks, that’d be awesome! I’d love a shout out – but maybe once I’ve actually got something to show or be recognized for!

I’m just now in the midst of starting a HK based B2C printing business; sourcing manufacturers in the Dongguan, Shenzhen area, designing my website, etc. Initially I hope to sell my designs to the wedding industry.

I currently live in Taiwan and will be making a trip over to HK within the next few months to get incorporated, open a bank account, and meet with some suppliers.

Hoping to be able to put some of your advice into action!

I’ll hit you up once I’m on the mainland, maybe we can grab a coffee or tea 🙂

Exciting to hear your new venture!

I do hop over to Hong Kong regularly, often to record for this show so keep me posted when you are there and we can get coffee

Once you get your business going I’d love to interview you and you can share with other listeners!!

thanks, Mike, that sounds great! I’ll keep you updated!

hey Jack, we finally got that Paymentwall interview up – not sure if you had a listen! https://www.globalfromasia.com/merchant-accounts-hard-hong-kong/

Pingback: Hong Kong startup Ambilabs & Crowdfunding Experiences with Julian Lee - GFA46

Pingback: Should I Set Up an Offshore Company?

Wonderful article. Very informative. Do you have any update on Stripe and HK ?

I have an e-commerce business based in HK and right now, most of my customers comes from Europe. I’m currently using Paypal, but their new policy forcing users to create an account is making me loose customers. I’m looking for a good processing CC service that is easy and multilangual. (We can use Paypal Pro in HK, but it’s only available in English or Chinese)

Hey Nghia,

I totally understand your frustration… We all are frustrated here and waiting for Stripe to come…

I did a podcast on paymentwall that is an option some are looking at here is the link to the show https://www.globalfromasia.com/merchant-accounts-hard-hong-kong/

Worldpay is the one I have heard from friends that gives you the true merchant account experience in Hong Kong but it has a rather higher setup cost, Marie shared on it here https://www.globalfromasia.com/worldpay-merchant-account-process/

Hope this helps… Hope it gets better for Hong Kong online businesses soon…

Hi, thanks for the post just curious if there is any payment gateway at all that can be used in HK which allows website to accept credit card payments on own website without jumping to another platform given that the website is not PCI complianced?(ie, with paypal you have to “check out with PayPal” and customer are redirected to paypal platform for payment details

Thanks

Hi Jason,

From my research so far there are two options:

1. Worldpay

2. Paymentwall (via iframe)

Let me know what you find.

I have also heard Stripe may be coming to Hong Kong soon… I will post as soon as I find that out

Hi Michael, you heard that from reliable source?

Hi Cyril –

you mean about Stripe coming to Hong Kong soon? It is a well connected friend who goes to SV often….but ….I wouldn’t base my business decisions based on waiting for it to happen….

Thanks, it’s still giving hope.

Hi Michael,

great podcast.

We at https://Pencepay.com started accepting Hong Kong companies directly a few months ago, through a relationship with couple of HK banks. Our service is quite modern, similar to Braintree/Stripe, so the RESTful API and all the rest. There is NO redirection to our domain to pay (although you can use our hosted payment page if you really want) but there is client-side encryption of card number and other sensitive data, so you are 100% free to change the design of the payment page – no Chinese characters on your payment page. The service can be used for in-app payments as well. You can do ALL operations which gateway supports through the web Administration tool using our API, so it is quite on-par with the best US solutions. The Administration tool (which you can see if you sign up for free) is also quite modern and works on desktop and mobile devices.

The fees will always be higher in Hong Kong because card networks charge higher interchange fees for merchants in Asia, though.

Pingback: Merchant Account Comparison

If your business only includes local transaction, PPS is a good approach as well. Otherwise, the only options are Paypal and Braintree which cost much. Interestingly, even Hong Kong is part of China, Chinese payment methods seem don’t welcome Hong Kong merchants , for example, Alipay requires ICP license but HK business is impossible to apply it.

Thanks for the comment Lam!

PPS, I have not heard of them before, seems they are part of EPS?

https://www.eps.com.hk/eng/company_pps.asp

And is a Form of Bill payment

I agree with you about Hong Kong being stuck between China and the West, and Hong Kong is supposed to be a financial capital of Asia so why are there these issues….

I will have future episodes about icp in China, but yes you are right need a mainland Chinese company or Chinese local identification card to get it.

But there is alipay for Hong Kong companies

Get updates on my newsletter

https://www.globalfromasia.com/subscribe

Pingback: Struggling with Merchant Account Options in Hong Kong or Asia? Brainstorming w/ Daniel Kerr - GFA72

Hi Michael, have you interviewed Braintree? I know they have set up the team in Asia and accepting merchants in Hong Kong. I did apply it recently but my application is not handled in a professional way. They classify my business is high risk without telling me the reason, or suggesting me any arrangement that can lower the risk. My feeling is that they are not eager to do business here. Any findings from your side?

hi Vander,

Braintree I have had a ton of people emailing me and tweeting me as soon as they announced they were coming to Asia. I think Braintree is flooded with applicants and maybe a bit overwhelmed. I’m curious what your business is to be considered high risk? Maybe I can help – I do want to interview them – I hope to get them on soon

Pingback: 5 Things to Consider When Deciding Where to Setup Your International Business: Hong Kong, USA, China? - GFA89

just wondering if there’s any new update about Stripe in Hong Kong, this is Oct 2015, and i am planning on moving there for good.

Hi Manu,

Thanks for checking in – I’m constantly getting people asking me – and was at the RISE conference where one of the founders of Stripe spoke – they said planning for end of this year – but as of now I have not heard anything, received no email, social media updates, or anything… let’s keep hoping…. but there are other alternatives too. Will you wait for Stripe how long?

Thanks Michael.

I am currently in USA, and even when I move back to Hong Kong, I can keep using my US bank account for letting people deposit money and then transfer it to the local Hong Kong bank account if needed. But this is a pain!

Plus, I will have to put prices in US dollars on my website even if I sell locally, which means that both me and the clients will need to convert in their head to see how many Hong Kong dollars it will be.

This all could be rectified easily if Stripe just opened up a local beta option. They were supposed to be in Singapore, Japan and New Zealand by now, and they have made all of them successfully expect New Zealand. So I believe that they are fairly organized in their roll outs. So if they said they would be in Hong Kong by the end of this year, I have a very strong belief that they will. I will dance when that happens.

thanks for the additional insight on Stripe rollouts. When they’re in HK we can both join together for the Stripe dance, haahaha!

I hope they mean fiscal year.

man we are all begging for it, I know! …. !!

Pingback: Stripe Now in Singapore! Hong Kong Next?

Hi Michael, Great Article, this has been such a BIG pain point for my website. It’s amazing that a place like hong kong is dealing with 20th century problems :)– So far I LOVE working with Braintree, they are great, the only problem is they are approved for Mastercard and Visa only, so if I want to accept Discover, Amex, or any other card type I have to apply for an SC # on my own. For over a month now I’ve been dealing with AMEX Merchant Services, they have been a nightmare – I really hope either Braintree or Stripe has a solution soon.

Hi Christina,

True, I just don’t expect many people to use Amex – so many clients ask you for it ? How does one get AMEX for Hong Kong anyway? Would love any insights 🙂

Actually I know many people who use amex especially if they have gold card or above because of the awesome point system. I applied through their online service http://www.americanexpress.com/hk/en/content/merchant/contact-us-and-faqs.html they took forever to respond, so I kept emailing and calling until I got a hold of one of the account managers. It’s been almost 2 months and they still haven’t approved me and they won’t tell me why. That’s the most frustrating part.

Hi Christina,

You’re probably dealing with them in email? Or do you get them on the phone? I’ll call them on Monday and see what’s up, maybe I’ll ring their doorbell haha

stay tuned… and have a great weekend

Mike

Phone call first, then email – Ironically I have a call scheduled on Monday at 10:30. I will have my local friend on the call to translate if need be. Haven’t rung their doorbell yet 🙂 ~ Let me know how it goes for you… Cheers

So I talked to a client services – seems she was nice enough, based in MY!

She couldn’t find my account in the system, but I think my braintree merchant account supports American Express? I emailed Braintree support to see

If you read the FAQ here – https://www.braintreepayments.com/faq you’ll see it says it supports AMEX

maybe try that?

It looks like that’s only for US.

What kinds of payments can I accept with Braintree?

Merchants in the US can use Braintree to accept PayPal, Apple Pay, Android Pay, Venmo, Bitcoin and most credit and debit cards, including Visa, MasterCard, American Express, Discover, JCB and Diner’s Club.

Hi Christina,

I am also curious about this. The FAQ says: “All merchants in Singapore, Hong Kong and Malaysia can accept PayPal and cards on the Visa and MasterCard networks as long as the cards are enabled for online use. Currently, American Express is only available for merchants located in Hong Kong.”

Hi Matt and Christina,

Braintree Support got back to me – seems Amex works for Hong Kong – finally a +1 for HK business owners – here’s their email – same link as Christina shared, so still need AMEX account to be approved:

=====

Hi Mike,

I hope you are well! Your Global From Asia merchant account is definitely eligible to accept American Express.

In order to accept AmEx, we will need for you to set up a Service Establishment Number (SE#) with AmEx for each presentment currency you would like to accept Amex with. They can be contacted at: 2277 2277. Additional information can be found on their website here.

Once you’ve set up your account, we’ll need for you to fill out the attached pricing sheet for each currency with your SE number and business information.

You will be able to accept payments from AmEx cardholders with this connected, but please note that our support for this card type is currently in “beta”. As such, we are not billing you for these transactions at present (aka fee-free AmEx processing!). However, we’ll reach out to let you know when you can expect to begin seeing transaction charges for AmEx transactions.

Once I receive your documentation from that address I will have this completed as soon as possible. If you have any questions, please let me know!

Best,

Eric

BrainTree Support Asia

Matt and Matt 🙂

During my call yesterday with Amex, they wouldn’t give me a reason for denial. Braintree was kind enough to dig deeper and found out that the reason they denied me was because my company fell into the probhibited list category. So Now I have to decide to keep working with Braintree (Which I love ) Or find a new gateway that already hasan established account with Amex. Have either of you used EZPay? They have a contact # for HK but it’s incorrect. If anyone has the right contact # for HK please share.

HONG KONG

800 933 873

hk.contact@ezypay.com

Christina,

I’m Mike btw, hehe haha 🙂

How about Paypal Hosted Solutions in HK? Its linked in the article here – it keeps the checkout on your site

Or I have been told about https://eway.io/hk but don’t know anyone using it – they support Hong kong and worth a shot – with First Data

I also try to keep an up to date list on https://www.globalfromasia.com/merchant-account-comparison/

I have to look into paypal. I will check out eway – thank you

Hi Christina,

I checked with eway. They only support Visa and Master card for HK.

Yes I called them as well and got the same reply.

Here’s the latest wit AMEX HK

lots and lots of manual back and forth with a person in their company – and CNY has made it slower – but finally – he came to VISIT MY OFFICE last week…. he was in a full suit and kinda felt my office was not so nice (just the vibe I got)

He said they need audited financials, and etc etc and it would be HKD account at first. Can then go to USD but more strict and 200usd/year fee to keep it.

Not sure if I really want to go through all that to be honest.

Hi Mike,

Amex is only the fourth largest in the world by number of cards issued, but they are the largest in the world by purchase volume.

guess all the big spenders are on Amex, I’ll definitely try to get this approved and integrated w/ Braintree, awaiting Amex’s reply still.

Hey Mike, did you get Amex approved?

Hey Matt,

So they replied to me about 10 days later and been some back and forth. These are the latest questions I replied to:

How are you? Thank you very much for your information!!! May I know,

(1) Is Shadstone Limited a registered company in HK?

(2) May I know how long have Shadstone Limited been in the business?

(3) You work in HK office?

(4) You help your clients to get their HK Business Registration and to provide advices to them for setting up their business in HK? You also sell books to them?

(5) Does your website accept any credit card at the moment?

Together with the information above, I will forward your web address to my colleague for his comment.

Thank you,

Patrick

Strategic Acquisition, Hong Kong | Global Merchant Services |

American Express International Inc.

Hi Mike, thanks for the update. Curious how it will work out.

Pingback: Stripe Launches Atlas - Future of Cloud Incorporations?

Stripe is now available in Hong Kong. https://stripe.com/hk/pricing

trying to apply a close beta. hope it work ok.

great, I’m in the beta too and it seems smooth!

got my first payout to the bank. Full amount and on time. Also they are trying to bring settlements in USD very soon and reduce the time from 7 days to 2. Can’t tell my source though. Its high time to leave braintree as STRIPE does allow AMEX charges as well.

Wow, this sounds like a dream come true! thanks for the update!

Pingback: How to Get an American Express Business Account in Hong Kong

Pingback: Stripe Officially Launches in Hong Kong

Pingback: The Story of Neat Hk Developing in Hong Kong to Help the Banking Market with David Rosa and Igor Wos

Pingback: Stripe Released in Hong Kong!