Are you considering becoming an international seller on Amazon FBA? Venturing into the vast market of the USA and beyond? Today, we embark on an insightful journey, so lend us your attention and enjoy our condensed Asia-to-Amazon mini-course.

In our ever-evolving world, convenience is key. The days of trudging to the mall are long gone, as are the times when vendors relied on physical marketing materials. The question lingers: Can one still sell products successfully without the internet?

Related: Check our full Amazon FBA library for more guides and tools.

Commencing Your Amazon Selling Journey

Let’s delve into a few essential points today: the seamless global selling capability of Amazon and the liberating flexibility that allows you (and your business) to operate from almost anywhere on the globe. What advantages await those who choose to traverse international boundaries while selling on Amazon? Let’s explore.

The internet has revolutionized every facet of life. Through social media, advertisements, and various online channels, marketing and selling have undergone a significant transformation.

Selling products online not only opens doors to a broader audience and new customers but also provides buyers with a virtual shopping mall at their fingertips. The internet has dismantled traditional geographic constraints, redefining the way people engage in commerce.

Convenient Commerce

Behold, Amazon.com, one of the world’s premier online retailers. It has evolved over the years, offering a vast array of consumer goods, ranging from books to virtually everything imaginable. Beyond its prowess as a consumer hub, Amazon is a potent platform for sellers.

Boasting over 300 million users, Amazon provides sellers with an extensive pool of potential customers. With comprehensive categorization and millions of users exploring diverse product categories, Amazon is a haven for sellers, effortlessly catapulting products into the limelight.

As of today, Amazon spans 11 marketplaces, including the US, Canada, Mexico, the UK, Germany, France, Italy, Spain, China, Japan, and India. With 120+ fulfillment centers, a presence in 180+ countries, and a diverse range of product categories, Amazon is a gateway to international business expansion. Taking your products global elevates your business to unprecedented heights.

The Amazon FBA Infographic Experience

Prefer to check out images? We made a full infographic of this blog post for you to download and enjoy! Check it out now.

Why Sell Internationally?

The internet has made it easy to sell globally. It’s just one click and you have access to the world, so why not take advantage of it? If the business is doing well locally, why not step out of your comfort zone and introduce your products to the world. Test the waters. After all, it wouldn’t cost you that much and this could hardly put your business at risk. However, you’ll need extra time and extensive research to pinpoint which country/region you want to sell your products to. There are a few things to consider like the culture, the market, the law (restrictions, taxes and duties), the language, etc.

Selling internationally can be a great way to be a bigger fish in a smaller pond. There can be significantly less competition in other Amazon markets. If you’re looking for a great overview of the European marketplaces, check out this article from Vanessa Hung.

Navigating the Sign-Up Process

First and foremost, select the marketplace that aligns with your product offerings. When venturing into the realm of Amazon, understanding your business and its nuances is paramount. Focus on product viability, profitability, and marketplace appropriateness.

Be aware of regional regulations, such as Japan’s restrictions on goods violating wildlife protection laws. Language proficiency is crucial for effective customer support unless you opt for the convenience of Fulfillment by Amazon (FBA).

What is Amazon FBA?

FBA is basically sending your products directly to Amazon’s fulfilment centers where their warehouse would handle shipping, packing and customer service/support for your products. All you need to do is send your products/inventory to Amazon and let them manage the rest. This sort of program allows you to focus on other aspects of running your business (like marketing & advertising) while Amazon handles logistics, packing and customer service.

FBA is ideal for anyone who owns a small business because it could save a lot of time and money. Easy, right? However, this program is not free; you will have to pay for the fulfilment fees (per unit) and monthly inventory storage (per cubic foot). Please refer to this link for the fees.

If you’ve opted for FBA, Amazon will give you the details and shipping address of where to send your inventory and then you can sit back, enjoy a cup of joe, and wait for sales to come in (with a lot of extra effort on marketing, of course).

In addition to storing your products in Amazon’s warehouses, you can also store them in a 3pl, which stands for third party logistics. An example would be Prep It Pack It Ship It, in California. Prep Centers and 3PLS can help you prep or store products for a lower cost than FBA and then you can drip feed into Amazon FBA.

Unlocking Global Markets with Amazon Global Selling

Amazon Global Selling is a program designed to facilitate international business expansion by granting access to Amazon’s 11 marketplaces and millions of customers worldwide. This program allows you to sell across multiple Amazon platforms, opening new horizons for your business.

Here are several steps that will help you get started.

Getting Started in 5 Simple Steps

1. Understand Your Products’ Global Potential

Conduct a thorough analysis of your product catalog to identify items with the greatest appeal on a global scale. Consider factors such as cultural preferences, trends, and market demand in potential target countries. This step lays the foundation for a successful international expansion by aligning your offerings with diverse consumer preferences.

2. Research and Choose Your Target Marketplaces Wisely

Delve into market research to pinpoint the most promising and strategic marketplaces for your products. Each country has its unique consumer behaviors, regulations, and competitive landscape.

Evaluate factors such as market size, competition, and cultural nuances to make informed decisions. This meticulous selection process ensures that your products resonate with local audiences, enhancing your chances of success.

3. Create an Account and Go Global

Navigate to the chosen marketplace and initiate the account creation process. Provide accurate and comprehensive information during registration to establish a trustworthy online presence.

Tailor your approach based on the chosen marketplace, considering language preferences and regional requirements. This step marks the official initiation of your global expansion, setting the stage for an international customer base.

4. Opt for FBA for a Seamless Global Experience

Choose Fulfillment by Amazon (FBA) to streamline the complexities of global logistics and customer service. FBA handles storage, packing, shipping, and customer support, ensuring a seamless experience for both you and your customers.

By leveraging FBA, language barriers are mitigated, and your products benefit from Amazon’s renowned customer service, fostering trust and satisfaction among international buyers.

5. Start Selling

With your account set up and products prepared for global markets, it’s time to launch your listings. Implement effective marketing strategies, such as optimizing product listings, utilizing Amazon advertising, and engaging with potential customers through social media.

Monitor performance metrics and customer feedback to fine-tune your approach. The journey doesn’t end here; consistent evaluation and adaptation are key to sustained success in the dynamic world of international e-commerce.

Embarking on the international stage requires a blend of strategic planning, adaptability, and a deep understanding of both your products and the diverse markets you aim to serve. By following these comprehensive steps, you pave the way for a successful Amazon FBA experience that transcends borders and captivates a global audience.

Enter the World of Cross-Border E-commerce

Cross-border e-commerce has evolved over the years, with some tracing its roots to eBay’s entry into the Chinese market. While selling into Mainland China from outside is a facet of cross-border e-commerce, the broader definition encompasses international e-commerce, breaking down borders and facilitating global trade.

Related post – How to get started with Chinese-based cross-border e-commerce

This Discussion on Video

Watch this video with our co-host, Lyka, as she explains to you what Amazon is and how you can start selling on this e-commerce platform:

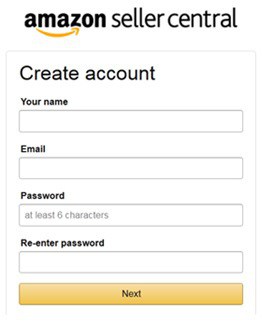

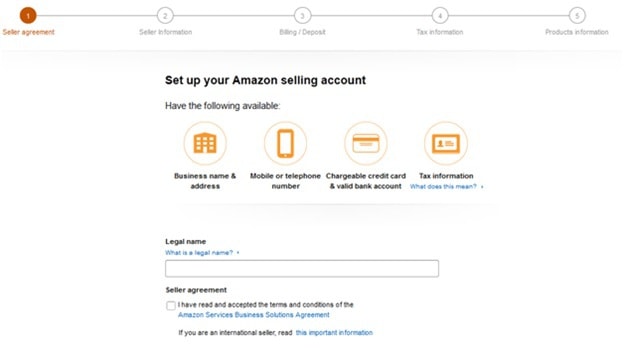

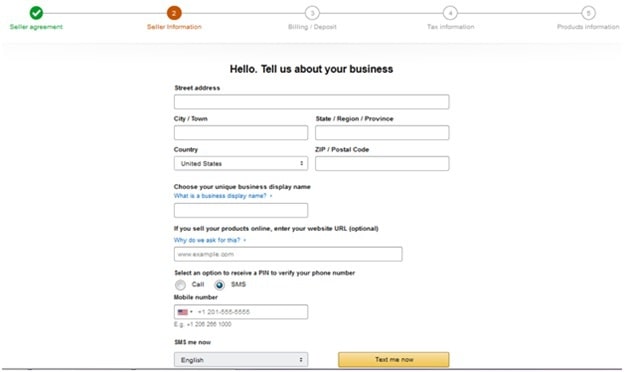

Amazon’s Registration Process

Embarking on your Amazon FBA journey requires a seamless registration process, a task easily accomplished in under an hour. To initiate this journey, visit the Amazon Seller Central account setup page. The subsequent steps, illustrated below, guide you through five essential stages:

1. Seller Agreement

Begin with the basics — your name, email, and a chosen password.

Source: Amazon.co.uk

2. Seller Information

Provide crucial details, including your company’s registration particulars, primary contact person information, and beneficial owner information.

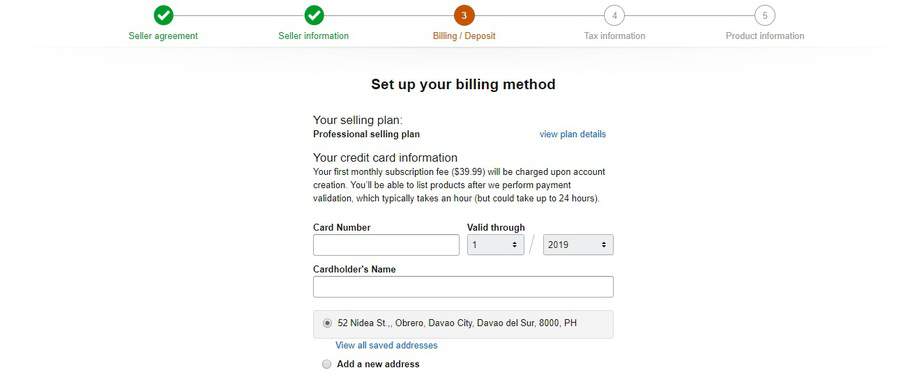

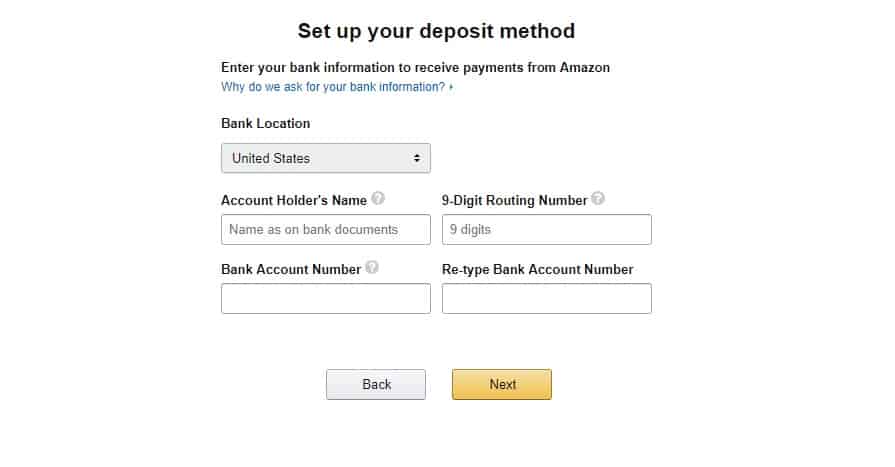

3. Billing/Deposit

Expedite the process by preparing your credit card details and a valid phone number.

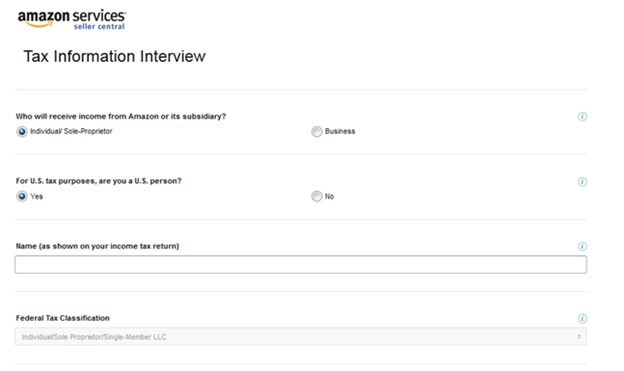

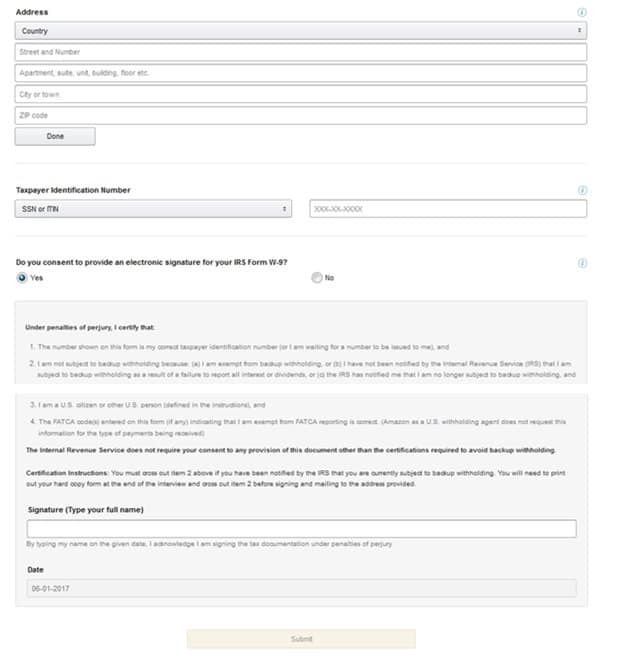

4. Tax Information

Furnish necessary tax details to ensure compliance with regional regulations.

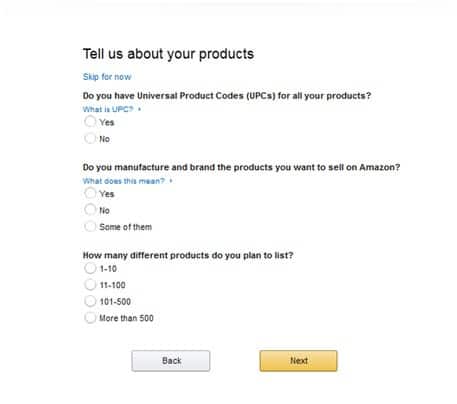

5. Product Information

Complete the registration by sharing essential information about your products, ensuring a comprehensive and trustworthy seller profile.

To expedite the process, you may want to prepare this information in advance:

Global Reach Without a US Company

Dispelling any concerns about needing a US-based company to sell on Amazon US, international sellers can operate from anywhere worldwide. While a US-based bank account is required for fund transfers, Amazon’s Currency Converter for Sellers alleviates international sellers’ worries by facilitating transactions in local currencies.

This feature enhances accessibility, enabling sellers to cater to a global audience without the need for a US-based company.

Seller Central Account Accessibility

As of today, Amazon provides access to its vast marketplace for sellers from 102 countries, transcending geographic boundaries. This inclusivity ensures that sellers worldwide can tap into Amazon’s expansive customer base.

Selling on Amazon as a Non-US Resident

You can sell on Amazon as a non-US resident. A popular choice for many international sellers is to establish their Amazon Seller Central Account in Hong Kong. If you’re contemplating selling on Amazon from Hong Kong, we delve into the reasons behind this choice in a dedicated blog post, highlighting why Hong Kong serves as an optimal hub for FBA business headquarters.

Cross-Border Payments and FX Fees

It’s crucial to consider the implications of cross-border payments and foreign exchange (FX) fees when engaging in Amazon sales. When Amazon remits payments, they do so in the currency associated with the country of your Seller Central account.

Unfortunately, many sellers overlook alternatives, unknowingly subjecting themselves to unfavorable exchange rates imposed by Amazon.

Explore our comprehensive guide and comparison on cross-border payments, featuring insights into payment provider solutions. This resource will not only guide you through the intricacies of the process but also empower you to make informed decisions, steering clear of potential pitfalls in the realm of FX fees.

Professional Seller vs. Individual Seller

Following successful registration, sellers face a crucial decision: opting for a Professional or Individual seller account. Assess the scale of your operation to make an informed choice.

- Professional Seller: For those with a substantial product catalog, a monthly fee of $39.99 unlocks benefits such as customizable shipping rates, promotional opportunities, and eligibility to list in exclusive categories.

- Individual Seller: Catering to smaller inventories, individual sellers incur no monthly fee but pay $0.99 per item sold. Sellers with fewer than 40 products may find this a cost-effective option.

Benefits of Being a Professional Seller

Choosing a Professional Seller account on Amazon unlocks several advantages:

- No fee per product sold.

- Account remains active even during periods of inactivity, albeit with a monthly fee.

- Customizable shipping rates.

- Ability to offer special promotions and gift wrap options.

- Creation of new listings.

- Eligibility for top placement on product detail pages.

- Exclusive access to categories such as Clothing, Shoes, Jewelry/Watches, Beauty, Collectibles, Automotive, and Video.

Sellers can seamlessly transition between Professional and Individual Seller status, adjusting their approach based on business needs and market dynamics.

If you’re still grappling with the decision to sell on Amazon, take a moment to explore Amazon’s comprehensive Ready-to-Sell Checklist. This invaluable resource is tailored to guide you through the essential considerations, aiding in your decision-making process.

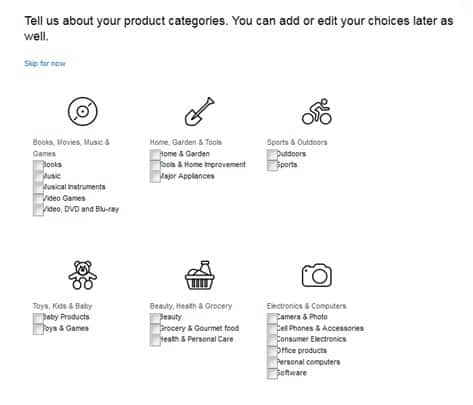

Preparing Your Products for Listing

Before your products grace the digital shelves of Amazon, there are crucial steps to follow. Begin by selecting an appropriate Amazon category that aligns with your products. Keep in mind that different categories come with specific requirements, such as invoices, images, and questionnaires.

Once you’ve identified your category, meticulously gather essential details about your products. Craft a compelling product description, succinctly convincing potential customers to choose your offerings.

Strive for brevity while ensuring your products shine through vivid descriptions. When it comes to images, adhere to Amazon’s product image standards by opting for professionally shot photographs. These visuals are your product’s first impression and play a pivotal role in enticing customers.

With your meticulous preparations complete, your product is now poised for its debut on Amazon, ready to capture the attention of online shoppers.

Addressing Tax Considerations

International sellers must navigate the intricacies of US sales tax. If devoid of a physical presence in the US, sellers need only handle customs duties and import taxes. However, a US-based physical presence necessitates compliance with US sales tax obligations.

For those venturing into the European marketplace, understanding Value-Added Tax (VAT) obligations is paramount. Sellers are responsible for collecting and filing VAT, with the need for professional advice to navigate the complexities of VAT in the European Union.

Choosing a Strategic Business Location

When it comes to establishing a business, the location you choose serves as a cornerstone for success. It’s not merely about finding a place on the map; it’s a strategic decision that warrants careful evaluation. Here’s an in-depth exploration of the factors involved.

1. Taxes and Upkeep Costs

Assessing the tax landscape is crucial for financial planning. Different countries have varying tax structures, and understanding the tax implications for your business activities is paramount.

Consider not only corporate taxes but also other levies and fees that might impact your bottom line. Upkeep costs, encompassing operational expenses, infrastructure, and compliance, play a pivotal role in determining the overall financial viability of your business in a particular location.

2. Tax Considerations for Overseas Markets

If your business extends beyond borders, navigating the tax considerations of overseas markets becomes imperative. Each jurisdiction has its tax regulations, and understanding the international tax landscape ensures compliance and prevents unforeseen financial implications.

This involves grasping the intricacies of cross-border taxation, transfer pricing, and any tax treaties in place between the countries involved.

3. Hiring and Centralizing Operations

The decision on where to centralize your operations is multifaceted. Considerations include the availability of a skilled workforce, labor costs, and the ease of doing business. Evaluate the potential for growth and innovation in the chosen location.

Additionally, if you plan to hire locally, understanding the labor market and legal requirements for employment is essential. Centralizing operations streamlines efficiency and often leads to cost savings, making it a pivotal aspect of the location decision.

4. Residency and Lifestyle Preferences

Beyond the business realm, consider the personal aspects tied to the location. Residency requirements, such as obtaining long-term permits or citizenship, may influence your decision, especially if you envision a long-term commitment to the chosen location.

Lifestyle preferences, including cultural compatibility and quality of life, play a role in ensuring a positive work-life balance for you and your team.

These considerations are not isolated factors; they are interconnected elements that collectively shape the trajectory of your business. The dynamic interplay of taxes, operational efficiency, human resources, and personal lifestyle creates a complex decision-making landscape.

Our detailed exploration of these considerations in our blogs aims to empower businesses, providing insights that go beyond the surface-level analysis. By delving into these factors, businesses can make informed decisions that align with their corporate structure and global operations, setting the stage for sustained success in an ever-evolving business landscape.

Amazon FBA Setup Challenges

The once-easy days of registering on Amazon FBA have evolved, requiring more due diligence. New sellers often need to submit proof of address documents, bank statements, and other activity proof before listing products.

While challenges exist, entrepreneurial perseverance remains crucial to overcoming obstacles in the ever-evolving landscape of cross-border e-commerce.

Questions and Feedback From Readers

We love getting questions and feedback from our readers especially for this topic. It gives us the validation that more and more people are going into Cross Border E-commerce. Also, we get to learn more about what help our community of e-commerce business owners need.

Here are some that were sent to us:

Hi I am from Saudi Arabia and I would like to start selling my products on amazon I would like to know if I am allowed to use amazon store. And if so, if they can do the delivery for my products?Soha

Saudi Arabia is not on the list of countries accepted for seller registration in Amazon. You can find the list here.

But be on the lookout though for Amazon has plans of expanding its reach and add a Middle East marketplace. Who knows, they might open Amazon selling opportunities too, in Saudi Arabia.

Hey! I’m a resident of Spain and I’m interested in selling goods on Amazon US market. I don’t have an LLC or any other form of legal entity in Spain. I’m a sole proprietor and would be working from home. Will I definitely need an LLC in my country of residence to start selling on Amazon US? I’ve verifiable internationally chargeable card information, verifiable phone number, and home address. Looking forward to your response!Mary

You would only need to set up your Amazon Seller Central Account so you can start selling.

Forming an LLC is not a requisite to selling on Amazon. If you want to keep your business structure under a sole proprietorship, then you can do so. Just check the regulations or permits needed in your country of operations.

A lot though are moving in the direction of forming an LLC. And, this is mainly for financial and legal protection as your business expands, which you may not get in a sole proprietorship structure.

The Future of Global Selling

As the world transforms into a global market, the future of selling on Amazon unfolds with exciting possibilities. Embracing cross-border e-commerce, Amazon continues to redefine the landscape, providing sellers with unprecedented opportunities. We invite you to share your thoughts on the future of global selling and cross-border e-commerce in the comments below.

Seeking Assistance with Amazon FBA Setup from Asia?

The Global From Asia team offers a network of specialists dedicated to aiding individuals in setting up their Asia-to-Amazon venture. Whether through services or a comprehensive course, we are here to guide you on the fast track to Amazon success. Fill out the form below, and let’s embark on your Amazon FBA journey together.

27 Comments on “How to Start Selling on Amazon FBA, Internationally (The Definitive Guide)”

how to buy from a vendor? I have been in contact with a sell(through amazon), he ask have I ordered yet? OK how?

hi David,

a vendor in Amazon – as an end consumer or for wholesale / resell?

Hi there,

I am from Australia and am new to selling on Amazon with the intention of selling in America. So I have got my first product together with logos, suppliers organised etc. but have just hit a slight speed bump with the newly introduced Amazon Brand Registry 2.0. From what I have read I must have my product/brand with an active/registered trademark (USPTO) which I have yet to apply for. I am going to apply for the trademarking ASAP, but I have 2 questions:

1. I only plan to sell in the U.S for the time being so should I just trademark my product in the U.S alone?

2. Is there any other possible ways rather than having to wait it out for the registered trademark for 6 months-year on Amazon? Or should I look at selling my product on Ebay or other avenues until this time period is up?

Look forward to hearing back from you!

HI Dylan,

I asked some others and they said this:

He can sell on Amazon without registered trade mark, but he won’t have the brand registry benefits @michelini Your friend does not need brand registry or a trademark to sell on Amazon US. Just an account with Amazon US to sell. Brand Registry can wait. In the meantime get tm registration going.

Pingback: Is Hong Kong Right For Your Amazon FBA Business?

Want to ask is there any benefit to have a ‘Prime’ account in Amazon? Thanks

Hii how can i find seller central site for different countries….

i liked your wrighting

hi i am anirban from bangladesh account create I want to send my own product to Amazon in my own country and send it to Amazon in my

country, I will do it only to learn business, so that I can start my business with a small amount of money, I want your cooperation.

Hi there,

Do i need to do business registration with HK government to start selling on Amazon professionally? and do i need to create a business account with the bank here in HK through which i process all my transaction with any party involved? or could i just start selling on amazon with my personal name (probably some brand name for the products i’m selling)and with my personal bank account and personal credit card?

Hi there 🙂 !

I admired your article! It’s really well explained, but I still didn’t find an answer to my concern. Can you please help ? My question is: How can we sell stuff with Amazon FBA service from Morocco? Do you have any idea?

Hello,

Thank you for sharing the article. It is very informative.

I am an international seller and have no social security number (SSN) in the US. When I apply for an amazon pro account, will it require me to have EIN number?

Yes, I have been doing Amazon FBA in the UK and US from Ireland for two years.

It is very straight forward to set up but it is also very important that you set up correctly from the start as Amazon doesn’t allow you to change your details easily and they will automatically suspend your seller account if you try to change your details.

I learned from a UK based seller called James Greaney. He is from Ireland but he has been selling on Amazon UK and USA since 2013. He shares lots of helpful tips on his Youtube channel Internetbizuni and I hired him to teach me the process when I first got started.

This is how you can sell on Amazon FBA from Ireland:

Use a UK LTD company.

Send your products to a prep centre in Northern Ireland and from there to Amazon FBA via low cost delivery service UPS.

Make sure to give your correct bank and company details from the start as they are hard to change later.

Do you mind if ask why set up a LTD in the UK? Ireland is an approved country.

Great article

Thanks for sharing. I picked up some gems from it 🙂

Hello there!

This is Alden from Italy, I am an Amazon Account Manager for several companies in Italy. Some of my clients want to expand the sales and start selling in the US. You say that is not necessary a physical presence in the US. But what happen if sales speed up? Do you recommend opening a company, e.g. LLC there? Where can I get some information about this?

Looking forward to your answer.

Best regards

Alden

Amazon FBA is great as it saves time from the seller’s end. It helps sellers to reach more audience while at the same time, giving them more time to work on marketing instead of logistics. Great!

Pingback: What Are The Top Amazon FBA Brokers To Buy/Sell My Business?

hey , thanks for the information , here is a site i found that may help for all the beginners who want to make money online-

hope i helped 🙂

lets become rich!!

any one interested in selling on amazon from anywhere in the world needs a partner to start . I am looking for a partner who has knowledge or has money or has a product or hav them all . Arab gulf country citizens are Welcome. Hopefully we can do some business together .

Please be advised the right partner is crucial to success in Amazon FBA

Hi there, Great article! Thanks for sharing.

I’m quite interested in selling on Amazon FBA but I don’t have a US bank account although I have an HSCB bank account from Hong Kong. Do I still have to open a US bank account or I can use the HK one?

Good Article though one of your feedback on your question was not adequete. The user from Saudi Arabia can sell on Amazon provided that they use an entity based in an approved country. For example if the Saudia Arabian reader sets up company in the United Kingdom or United States, so long as they adhere to British/American laws when it comes to maintaining the company, it is a UK/US based Amazon seller, even though the owner and director of that company may reside in Saudi Arabia.

Of course there are also rules in Saudi Arabia they will have to follow when it comes Controlled Foreign Corporations and as he would be a non-resident of the country his company is based in he would need to file for the proper taxes and tax exemptions in those countries.

Of course a lawyer and/or accountant with expertise in setting up and running a foriegn company would be desirable and nessesary in some cases.

Awesome article. I’d love to dig a bit deeper on the next step for FBA Private Label Sellers: register their brands on Amazon’s USA Brand Registry. Thanks!

This is a great procedure article on how to start selling on Amazon. Very helpful for the ones selling wanting to sell on Amazon. It has got huge advantages and WHY NOT sell on it is not a question but it’s an answer. I mean, why not?! Its Global Selling Program is just killing it in today’s world.

Good job! Thanks for the guide! Would you recommend using next level ninjas? I heard that they could help out a lot!!

our pleasure, have not heard of that firm so cannot comment unfortunately. – Mike

Pingback: How to Triple your Ecommerce Sales By Going International with Tommaso Tamburnotti