The US-China Trade War has kept the whole world on its toes. What was thought of as a bilateral dispute between the two countries has become a global economic concern. The friction between these two superpower economies created ripples of impact to other countries, distorting world supply chain, putting the future of international trade in general, at risk.

While it may seem that the dispute can make winners out of other smaller countries, as the US and China go to them as an alternative, the fact is no one really wins in a trade war. When the US announced a tariff increase, China retaliated and imposed the same as countermeasure. Then US banned Chinese companies from purchasing from US companies and China came up with a list too.

They got back on the trade talks table, relaxed some tariff regulations but just shortly after, they’re at it again – imposing additional tariffs, one declaring the other a currency manipulator, then more tariff adjustments were made. The rally of measures and countermeasures between these two just goes on until who knows when.

Why are the consumers the greatest losers in this trade war?

The ones that will suffer a great loss are the consumers who will ultimately bear the rising cost of goods and most of these goods are not easily substituted.

Businesses in these countries have gone more creative in trying to circumvent the tariffs of this trade war. Some China suppliers ship their US-bound products to other Asian countries. Others ship parts to countries like Mexico where these shall be assembled into a product labeled as Made in Mexico or Assembled in Mexico before shipping to the US. Sellers may have considered other countries like Vietnam for their supply and other marketplaces that may not be as lucrative as the US market.

While there are many options other than what were mentioned, it should be noted that they come at a price. The more layers, the more costs that will be incurred. It is true that the importers bear the cost of additional tariffs. But these costs are passed on to the consumers making products more costly than in the pre-trade war.

The legal loophole to avoid US tariffs

As the trade war escalates, importers and exporters to the US alike have explored options to avoid the rising tariffs. And, they turned to this trade rule that instantly became the sure-fire solution.

Section 321 of the Tariff Act of 1930 provided the avenue for importers to avoid the additional tariffs currently being imposed on different products. They have taken advantage of this tariff-mitigation strategy which is Section 321 even if it would entail more administrative and logistical effort.

This also became an opportunity for logistics companies along with groups of lawyers, particularly in Hong Kong, to set-up one-stop shops for Importers in the US and exporters from China if they are to use Section 321 to minimize their cost.

What is Section 321 – de minimis rule

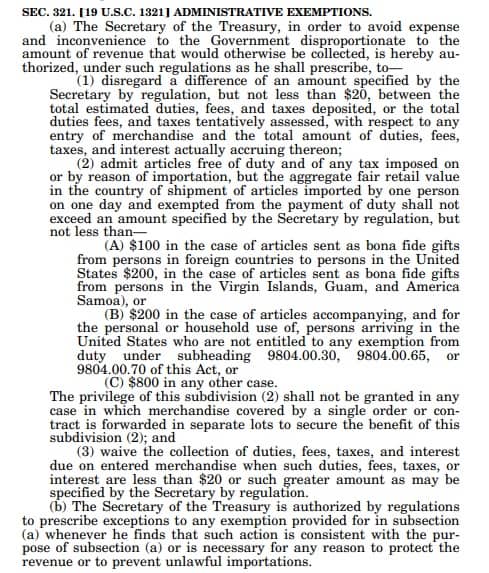

Section 321, or more specifically, Section 321 (a)(2)(c) of the Tariff Act of 1930 as amended, authorizes single shipments into the US, of goods with a value not exceeding $800, by a single person or entity on one day, free of duties and any taxes.

The US Customs and Border Protection Agency (CBP) in its Government Issue Paper on Section 321 laid down these conditions for those shipments with value not exceeding $800, that will be cleared free of duties and taxes:

- The shipment must be imported by one person on one day;

- The importer must provide evidence of the value by an oral declaration or the bill of lading (or other document filed as the entry) or a manifest listing each bill of lading;

- Consolidated shipments addressed to one (ultimate) consignee shall be treated as one importation;

- No alcoholic beverage, perfume containing alcohol (except where the aggregate fair retail value in the country of shipment of all merchandise contained in the shipment does not exceed $5), cigars, or cigarettes shall be exempted from the payment of duty and tax under these provisions;

- The exemption to entry is not to be allowed in the case of any merchandise of a class or kind provided for in any absolute or tariff-rate quota, whether the quota is open or closed. In the case of merchandise of a class or kind provided for in a tariff-rate quota, the merchandise is subject to the rate of duty in effect on the date of entry

This is also known as the de minimis rule. If taken literally, de minimis in Latin means, too small or minimal to be given consideration, especially in law.

But this loophole in a law also opened doors for manipulation and abuse. The exponential growth in the use of Section 321 gathered the attention of the US Customs and Border Protection Agency (CBP). Their launch of Section 321 Data Pilot is being seen as a crackdown for potential manipulation.

Section 321 Data Pilot

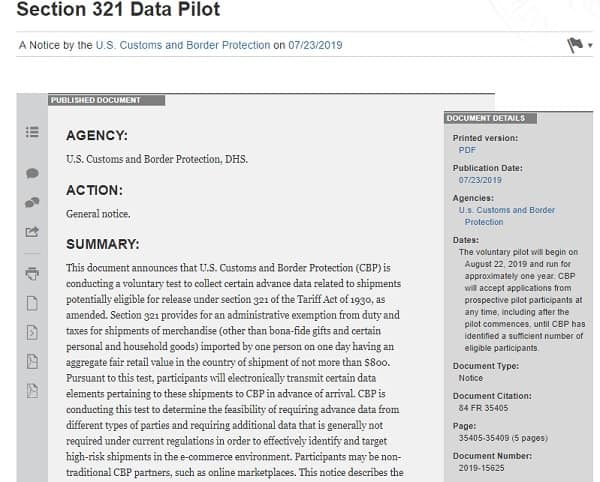

The US CBP said in its notice dated July 23, 2019 that they will conduct a voluntary test to collect advance data related to shipments that are potentially eligible for release under Section 321.

They further said that they are conducting this test to determine if it is feasible to require advance data from different shipping parties and impose additional requirements that are not commonly required under the current regulations. They want to identify and target the high-risk e-commerce shipments.

The test will run for one-year starting August 22, 2019 where CBP shall accept applications from prospective pilot participants at any time until they can get the number of participants that they deem sufficient.

So, why is this seen as a crackdown for those trying to avert the US tariffs?

Taking advantage of the loophole of Section 321

The exponential growth in the use of Section 321 set off the alarms of US customs authorities. And, if the actions being taken by importers and exporters to the US are proven to be in violation of the provision under Section 321, they have the authority not to grant the exemption and can confiscate the goods.

What are these potential violations that led the CBP to go on a crackdown?

Undervaluing imports or exports to the US

There are suppliers in China that admitted to intentionally put a lower value on their shipments than what they are truly valued for. This is being done to keep the value of their shipments below or within the threshold of $800 and thus, be exempted from customs duties and taxes.

Split Shipments

While Section 321 explicitly provided that if a single shipment is done in separate lots to secure the benefit of exemption, it is rather difficult to prove that it was done intentionally for that purpose. Other importers have split shipments into different days to obscure what could be considered a single shipment. Others used different shipping lines or couriers in an effort to create a semblance of different shipments.

Direct delivery to US consumers

This might be a solution that can cause savings especially to online businesses that naturally have several consumers with low-value shipments. For large scale, business-to-business models, this may only be too admin-intensive to be even considered.

Developing complex online systems

These online systems are complex and sophisticated as they apply de minimis to a great number of products. This will work well with online businesses as they are shipping to several buyers. But while this can afford the importers or retailers huge savings, the downside is that the administrative tasks that they must do can be overwhelming. This may not be after all too cost-efficient.

Bulk exporting to tariff-free warehouses

It was reported that lately, there was an influx of importers and manufacturers setting up warehouses in Tijuana, Mexico. This is so as they are not prepared or ready to move their factories or suppliers outside of China. Products from China are imported into and stored in the tariff-free warehouses in Mexico that fulfills the orders to US Consumers.

This is the same with the warehouses in Canada that imports China products in bulk then delivers the goods across the border to the US by truck, tariff-free.

When will this all end?

This is a question that begs an answer or a resolution – and, at the soonest time possible. But some experts in the business world are not seeing an end in sight, at least not in the near future. That became especially clear when US President Trump declared that waging a trade war with China is something that he has to do.

So for as long as the tariffs are escalating at speed and US customs clear eligible low-value shipments, Section 321 is the way for importers and exporters to go.

If you have thoughts on Section 321 that you would like to share, please do so in the comments below. We would love to learn more.

2 Comments on “Section 321 – How Importers Get By US Tariffs”

Pingback: Bypassing US Tariffs Via Hong Kong

Pingback: Asian Countries That Benefit From the US-China Trade War