Our podcast interview for today is a special one for me – bridging two different worlds. We are talking about Non Fungible Token, handshake NFTs, a little bit of crypto, dWeb, just kind of a lot of announcements and a lot of cool, amazing things to talk about today with our awesome guest who is a crypto influencer investor in Hong Kong. Let’s tune in.

Topics Covered in this Episode

Intro Jehan Chu

At Global From Asia, we had interviews with Larry Salibra and Leo Weese, also founders in the Hong Kong Bitcoin Association and great ambassadors of blockchain. So glad to have you on the show!

NFT - Overview

So I think there is so much we can talk about, but let’s focus on NFTs. Can you share what they are and why you are so excited about them.

You recently bought NFT/ on handshake blockchain

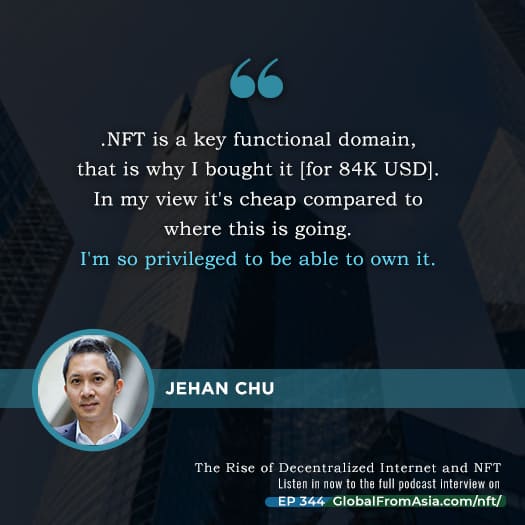

So you made news when buying NFT/ TLD on Handshake HNS at a record price of approximately 84,000 USD early in Feb. Can you share your insights on the deal?

Collectibles Market: You’ve worked with Sothebys in the past - NFT is the future?

I recall reading you see NFT as the future of arts and collectibles. Can you share?

The current state of the Art and collectible market

Where do you see the majority of Art investors now, are they embracing NFTs?

Asia market, NFT, Collectibles

Being in Hong Kong, what do you see as your advantage (or maybe it could be any disadvantage?) in the NFT and blockchain market.

How can people get involved?

What are some ways people listening, who have just heard this keyword NFT for the first time, do if they want to get some exposure?

Choosing a blockchain for NFTs

From my studies, the trust of the NFT’s value and rareness is also dependent on the trust of that blockchain. Ethereum and Tron from my research seem to be the top blockchains for NFTs, as they host the smart contracts of ownership and uniqueness. Handshake is another blockchain, how do you see the connection?

What you are working on and how people can connect / learn more

Curious to know what projects you are into and how people can connect or learn more

Thanks so much for sharing!

Appreciate your time and insight.

After the interview, Mike will share his thought process on why he feels propelled to put as much effort as he can on making the decentralized web a reality, so stay tuned!

People / Companies / Resources Mentioned in this Episode

√ Jehan Chu’s VIP Page

√ Kenetic.capital

√ Jehan’s HNS Dlinks profile

√ Niami rating system

√ Namebase.io

√ Flare.xyz

√ Sothebys

√ Larry Salibra’s interview on Bitcoin for cross border trade

√ Leo Weese’s interview on Seasteading

Episode Length 42:25

Thank you so much for sharing, Jehan. I really appreciate you sharing with us that I’m all excited. I’m jumping back and see the auctions now. I hope everybody got inspired as well.

Download Options

- Direct Download: Right-click here and click “Save As” for a direct download

- iTunes: Listen and subscribe on iTunes for free!

- Android: Check out Android Options or Listen via Stitcher Internet Radio streaming

- If you enjoyed this episode, leave a positive review on iTunes, & more (directions here)!

Show Transcript

gfa344

[00:00:00] Episode 344 of Global from Asia podcast, handshake NFTs, dWeb, just kind of a lot of announcements and a lot of cool, amazing things to talk about today. Let’s go into the episode. Welcome to the Global from Asia podcast, where the daunting process of running an international business is broken down, into straight up actionable advice.

[00:00:26] And now your host, Michael Michelini. Hey everybody. Thank you for tuning in. This is a special one for me. I’m kind of bridging two different worlds together. It’s going to be globalfromasia.com/nft. Non Fungible Token. A little bit of crypto, we’ve talked about crypto for so many years. Since the early days, you know, in 2014 is our first one, 13.

[00:00:49] Maybe we talked, we had Larry Salibra here talking about using Bitcoin for Cross border trade. We were using, we had a lot, Le. LEO, is what we use. And we had some amazing guests over the years. We had like Adrian Bye talking about how he’s doing Bitcoin back in like two, I lost it. I was doing out of already 15.

[00:01:07] We had some ICO stuff, 2017. I mean, we took it. We haven’t talked about too much, but the last year now, I want to say a year, about last half a year or so, I’ve been really studying this a lot more, honestly. Bitcoin is boring to me to be honest. I know, I know a lot of you love money, but I’m more on the internet content marketing, and I’m also really tired of, you know, this walled garden we live in. Amazon is a walled garden of, you know, Facebook and Twitter.

[00:01:35] That just control our identity, control our content. That’s what I like about podcasts. You know, it’s a little bit more open, you know, it goes into iTunes, but also has these feeds all over the internet. So today’s show is gonna be the first of a multi-part series, at least three or four part series about dWeb, decentralized web, you know, NFTs crypto a little bit.

[00:01:56] And we have a great, great guest with us today to start this mini series off the mini series, we’ll put at globalfromasia.com/handshake, hand shake. It’s a HS ticker, and it’s really been changing the way I’ve been thinking about the internet and life and Jehan Chu. He’s a crypto influencer investor in Hong Kong.

[00:02:17] He has a fund, he’s investing, making a lot of investments. He’s an early stage investor in handshake which is what we’re talking about as well as name base IO, the main marketplace of this, of this new decentralized naming system. And we are talking about NFTs, talk a little bit about the Asia market, Hong Kong. The importance in this, we’re talking about some ways that you can invest in this and get involved.

[00:02:43] I’m a big, big game, really involved with this myself and after the interview, we’ll talk about some things that I’ve been doing and what, how Global from Asia is going to be moving more into the dWeb itself with some very early stage social network installations we’re doing so without further ado, let’s get into the episode.

[00:03:01] Are you a non-us citizen looking to get some USA banking for your company? In Global from Asia, we are bombarded with people begging for bank accounts in the US. It’s something that we’ve been trying, to help people. And we’re so happy to have a partner in this, the right partner, mercury.com. They have online banking, no need to go there in person, no need to be a U S citizen and, and you get us banking and no application fees.

[00:03:24] Even get a bonus if you use our link so globalfromasia.com/mercury to go to our link. Whereas a cash bonus. Of course there’s some terms of things you have to do. It’s not just going to give me free money, but you’ve got to do something. Or when you sign up or use it that you can read it down the link and it helps out the show and they, they, I feel like what you see, check them out.

[00:03:43] Mercury. Thank you. And then the second one, or does he have a full review? I made a video global media.com/reviews/mercury. You can see me again and I show you how I applied and see if some tips from how you can apply. Thank you. I’m a, I’m a client. Thank you. Thank you, everybody for tuning into our global from Asia podcast, we’re in for a special treat today, going into a little bit of the world of crypto again, and some, some amazing investment opportunities.

[00:04:09] Jehan Chu, he is a founder of Kenetic Capital. He’s been in crypto investing since 2013. He’s a co-founder of the Hong Kong Bitcoin association, where we’ve had some other friends in that space there. And it’s, we’re going to have some talking about NFTs and collectibles and crypto. So thank you so much for coming on the show.

[00:04:30] Yeah. Thanks so much for having me, Mike, excited to be here, excited to talk about NFTs and handshake and anything else that comes up. Yeah, there’s so much, honestly, it’s going to be hard to keep this one short man. There’s just so much, there’s so much to share. And we haven’t really talked about this too much on this show on the Global from Asia podcast, but I thought it would be a good, good time.

[00:04:47] You’re based in Hong Kong. You’ve been in the, in the space. So for so many, so many years in early years. So can you just give us a little bit of your background and how you got into the whole world of crypto and, and, you know, back in 2013 and. Yeah. Yeah. So my background actually is I used to be a front end developer back in the first.com boom.

[00:05:07] And then I was recruited by Sotheby’s auction house in New York, and I was helping them to kind of do a lot of internal work and also build out their auction platform, their online auction platform. And we very famously sold the declaration of independence. It was the last remaining copy in private hands.

[00:05:23] We sold that as the first lot and I moved, they moved me out to Hong Kong in ‘06 and I left Sotheby’s in 2008. But during that time I had started collecting arts. I became an auctioneer and I was, you know, getting really involved in the art world. And then when I left, I became an art advisor and I was helping, you know, basically family offices and ultra high net worth individuals

[00:05:46] to build art collections because I was collecting art myself. And, I was investing in art and doing all this stuff and just, you know, being a man about the art scene, I guess you could say. Great. And so I did that for a long time and I was really, I was fully in the art circuit. Like I would go to, you know, the Vienna, and I was going to art Basel and all this kind of stuff.

[00:06:04] And it was a lot of fun, but late 2013, I discovered Bitcoin through the, it was actually for the Winklevoss twins who I had been kind of following since we were investors in the same startup called paddle eight, and I was just following what they’re doing and that kind of clued me into Bitcoin. And then I just started to look into it.

[00:06:26] I fell down the rabbit hole as one does I bought my first Bitcoin from Arthur Hayes actually. Okay, who was also in Hong Kong at the time. And yeah, I’ve started, we all started at the Bitcoin association and then I later founded the Ethereum meetup because I was more interested in the technology and applications.

[00:06:43] So I ran that meetup until now. I still run my meetup. And along the way, I got really into advising some early projects and investing to the point where like I was spending more time. In crypto than I was in my art job. And I decided to make the change and make the jump. So I went full-time into crypto in 2016 and you know, I, I started what has become Kenetic.

[00:07:05] We were, we’ve been investing, we’ve been trading OTC. We’ve been advising. We did the first NFT global event called Nifty back in 2018, where actually a lot of people that are really, you know, kind of prominent in the NFT space, I actually met. So that was like a lot of their first time, the first time that many people kind of coalesced around this idea of NFTs.

[00:07:26] So I’m super proud that we were part of that history and then fast forward to today. I mean, we’re investors primarily, we have a separate high-frequency trading business, but we’re mostly investors. We invest in equity. We invest in tokens. I mean, things that we’ve invested in that people would have heard of would be.

[00:07:42] Everything from like icon to QTM to OMI say, go all the way down to like seed investors in parody, seed investors in polka dots, seed investors in block fi serum and decentral land. And so yeah, a lot of stuff we’ve done over 160 investments and it’s beenan incredible, incredible ride. Amazing. Amazing.

[00:08:02] Yeah. That’s really, really a really amazing story. And yeah, I know you’ve done great things in the Hong Kong, you know, association Bitcoin association and the community with your events and, and, and helping getting more people there. I mean, Hong Kong is really a hot spot for crypto, right. It’s always kind of been supportive of it.

[00:08:19] Would you say, or, yeah, it’s, it’s been amazing because Hong Kong is this, it’s like a, it’s historically a trading port. And I think that that. Kind of being in the middle of things is, is very much part of its history. I think that lends itself well to the whole kind of position in crypto where it’s not inside of China, but it’s not, you know, in Silicon Valley, it’s, it’s always been this hub.

[00:08:45] And for sure, like even when I was in the early days when I was running my Ethereum meetup, I think my meetup was kind of like a hub for blockchain activity in the early days. Because if a company was coming from the West. Into Asia, they would definitely stop through Hong Kong. And if they were suffering through Hong Kong and I knew about it, I would be hosting them at my meetup.

[00:09:05] So a lot of people learn about these, these early companies, everything from like, you know, status. And, you know, when we say, and these things through my, through my meat of it, And I think that, you know, Hong Kong just has a privileged place, even now with everything that’s happening in the world. And China, it’s still very much like a, you know, a center point and this kind of like waystation where things just pass through and, and it benefits from all of this kind of.

[00:09:28] You know, kind of traffic through it and there’s, you know, world-class, you know, professional services here, it’s a financial center. So I think we can expect Hong Kong to remain one of, if not the center of kind of blockchain, you know, activity in Asia. For sure, for sure. I I’ve always, you know, this show has always been a very, you know, in love with the Hong Kong cross-border and the bridge, and, you know, he got the miners in China and he got, you know, they’re selective, you know, especially in, China’s a huge supporter of the blockchain in general, and then you’ve got the West and it’s, it truly is a great, great bridge, bridge there.

[00:10:06] And it’s another, another bridge that you’ve, you’ve kind of hinted towards social. We’ll try to focus on today is NFTs and collectibles. So, you know, I feel like you’re in this perfect position. You have, you have your previous experience with collectibles and art, and then you got into crypto and then I don’t know, maybe I’m wrong, but I feel like NFTs are still kind of new, relative to like traditional Bitcoin or BTC.

[00:10:27] Right? So now it seems like this is the hot new topic of collectibles on the blockchain called, called NFT. Was that the correct way of calling it NFTs? Yeah. Like, yeah. I mean, as far as like collectibles on the blockchain, is that, how would you tell somebody what is NFT? Really? Yeah. So I think that NFTs it’s, it’s kind of hard to, to talk about a bit because the NFT is just used to mean virtual assets, but now, like the definition of NFTs is just blowing up.

[00:10:58] It’s music gaming, it’s fashion. And we haven’t even really started to touch on enterprise and industrial NFTs. We will absolutely be seeing NFTs, which represent critical business functions, whether transactions or even representing like IOT and machines. So like machines and components, willl all be NFTs.

[00:11:20] We’ll all have like this layer of identity. So ultimately what an NFT really is, it’s an identity layer for physical and digital objects. Okay, which helps to enforce this scarcity and the identity. That’s what an NMT is. So really we’re going to have to stop using the word NFT and start using words like digital assets, digital arts, all of this, you know, digital machinery because the, the digital twinning, which NFTs provide the ability to actually represent real world assets in the digital world.

[00:11:56] Is what NFTs is only one of the use cases of entities. So mostly NFT is it’s like, Oh, it’s like art. Or it’s like, you know, kind of gaming or something like this. But really that, that NFTs as a, as a catchall for the overall kind of industry is, is gonna, is going to go away pretty soon because there’s too many use cases.

[00:12:14] Like you’re not gonna know people are talking about, Oh, you’re into NFTs. It’s like, okay. But like what kind of entities. So it leads into the actually okay. But what kind of takeaway? Yeah, that’s true. But I mean, I, you know, I, you know, you, you recently bought an NFT extension on handshake, which is really amazing and that’s perfect use cause you have tech dot NFT or, you know, art dot NFT is one, one idea of using that.

[00:12:42] Cause now NFT is becoming so huge. It’s becoming a multiple platform ecosystem in itself. Yeah. Yeah. Yeah. I mean, probably, you know, you’re wearing a handshake hat, so, I mean, I’m unable to shake maximalist. I love handshake. We’re invest, we’re seed investors in handshake. We’re investors in name based like I’ve been buying domains, like, like, like an addict.

[00:13:08] So for me buying the NMT domain name was like a no brainer. I hunted it down. I was fortunate to, you know, kind of work with someone really good. On the other side of the deal, the deal was brokered by name base. And the reason why I bought the dot NFT domain is because again, thinking about the position of NFTs as an identity layer, I think the dot NFT handshake domain, you know, this uncensorable decentralized, you know, domain system is the perfect naming layer for NFTs.

[00:13:38] So if I want to kind of name something. You know, like an artist’s work or a piece of property, I can use the sub-domain space basic as prefixes to basically name it dot NFT and.net. If T I think is a, is a really key functional domain. So that’s why I bought it. And I, you know, the price is published. It’s like 84 K U S.

[00:14:01] And I just handshake’s been going up. So it’s actually in handshake terms, it’s a lot more expensive now, but it’s in my view, it’s cheap compared to where this goes. It’s since incredible investment. I’m so privileged to be able to own it. Now I’m just, you know, working out exactly how to kind of make it available to people so that they can use it.

[00:14:18] And I really want to emphasize, you know, the use of dot NFT in the art world, in the design world, in the gaming world. But of course I’m not in a Russia. I think this is a long-term bet. Yeah, for sure. It’s a long term. I mean, I think anybody in this, anything, especially on investing should always be long-term.

[00:14:36] I mean, you probably know that better, better than me, but at anybody listening, of course, it’s a, it’s a long-term thing. And anytime you do something short term, you’ll easily, you know, you can get lucky, but you know, it’s, it’s always better to be a long-term investor in any, anything in life. I, I just want to give some quick insights for some that might not know.

[00:14:53] Because I actually haven’t talked about handshake before on this show, but basically maybe, or maybe you could, maybe you could say better, but like you’ve already kind of been hinting towards it, but it’s decentralized naming domain names, I think is the best way to call it. Yeah. So handshake is, is basically the, I call it the front door of the decentralized web it’s, you know, if, if Bitcoin and, and you know, other stable coins are the currencies of the decentralized web and.

[00:15:21] And file coin and storage or the storage lockers. And, you know, they’re all the kind of great decentralized financial applications are out. There are doing finance for defy them. Handshake is the front door of handshake is the way that you find everything. It’s the natural language naming layer and really what it is.

[00:15:40] It’s decentralized domain names. It basically takes what ICANN, the international body, which governs all domain names in the world, regardless of where you are. It takes that function and takes it out of the hands of a centralized authority, which is both prone to inefficiency and subject to either influence or censorship or corruption.

[00:16:03] And it creates a purely open system where they are, it almost creates a parallel internet because when you have access to an internet, which is uncensorable via the domain name, It creates a completely separate space where there is no real boundaries about what you can say, what you can do. There’s not as much kind of centralization of kind of influence.

[00:16:30] And so handshake is the gateway to all of that without handshake and without decentralized domain names, we’re still, there’s still a very key point of censorship potential in the domain space. So that’s what handshake is. And, and, you know, it was founded by Joseph Poon and other from lightening and a lot of other great people and named base is the main kind of platform like, like the Coinbase/GoDaddy of handshake.

[00:16:56] But handshake is now getting attention from some of the top domain. Buyers like a guy named Andrew Roessner. Who’s like the grandfather of domainers, you know, he sold zoom, he’s sold x.com. He sold all these and he’s actively like investing in looking at handshake. So this is no longer like a lab experiment.

[00:17:15] Like this is real world now and real money. So, yeah, I’m super excited about shake. Yeah, totally. I mean like you see I’m wearing a hat and I’m starting to introduce it into this show with, with this episode actually, because yeah, it’s, it’s a little bit alarming to introduce things to early stage, you know, but it’s definitely getting more like, There was names con, which is like a domain investing community.

[00:17:35] And they had our online event. I attended it in January and it’s getting more, more, more talks. And then also Michael Scyger is another domain investor and influencer. He just talked about his scyger.name on his Twitter, just literally 12 hours ago before this recording, he put it out on Twitter that he was amazed because Puma browsers supporting it natively now on iOS.

[00:17:58] So you can just type in his last name is his last name is Scyger. S C Y G E R. So he showed a screenshot. And he just typed in Seiger and it shows his de-link, which is, you know, for it’s like the name base is a profile page on his, on his screenshot. And he was pretty amazed at it. It works like, yeah, I have mine too.

[00:18:16] So if you just go to touch your hand, like if I need, okay, awesome. I’ll check it out. My, my crowning achievement is that I own the dot shit. S H I T. Okay. Idea. I own that. I own that domain. So I’m open to any and all proposals about what to do with the, the, the handshake shit domain.

[00:18:38] I think there’s massive potential for it. Yeah. I mean, I’m also addicted. I don’t, I don’t have as many names, but one is GFA. So our show is global from Asia. So .GFA for the, for the shorter one. And we’re going to try to put some profiles there for people. Yeah. 3Ls are good, but yeah, I mean, it’s, it’s, it’s collectables, right?

[00:19:00] Domain names, even in traditional are, are, are being traded a lot, you know, on online and the prices of dot coms are going up up like crazy. So it does seem like, kind of almost, almost, almost like obvious one that still seems undervalued. Like, I mean, like you said, the coin has gone up. It’s actually been done really well in the last month or two, H and S is a ticker.

[00:19:22] And even right now, it’s up. Uh, pretty good. I mean, of course everything is up in crypto and I’m sure you’re doing pretty well with your portfolio, but even actually nest itself is doing really well. And so let’s let’s and I do want to talk about the Asian market. We do try to kind of talk about cross border and in Asia, within our show.

[00:19:41] And I think honestly, the China market has always been a big buyer of domain names. Right. And I think. With blockchain and domains and invest me investments. I see the Asia market really interested in growing into this and to handshake and NFTs and, and collectibles. I’m sure to be Frank, I don’t, I don’t know much about the, the Asia domain market.

[00:20:04] So my background isn’t so much as a domainer like, it’s more like a handshake guy, so I’ve, I’ve been fortunate to learn a lot about domains. Unlike people like Andrew and just reading, you know, some of the forums, like learning about how people think about domains is fascinating. So I’m very much a student in this world trying to understand like what the different, uh, strategies are for acquiring and using demands.

[00:20:25] But I also think that the game is done changed a little bit because you know, it’s not, it’s not about what happens, you know, to the, to the right of the dot. Now it’s, it’s kind of what what’s, what’s interesting to the left of the dot we can shake kind of flips the script. So instead of owning.com, you can now own, you know, Mike or GFA or, you know, dot Jehan and the possibilities of that, like completely free flips the script that makes, you know, what’s to the right of the dot ubiquitous.

[00:20:54] So I think that’s, that creates very, very different dynamics for how you think about what’s valuable. Right? So maybe I don’t necessarily need like pets.com. Because, you know, I’ve got pets, but then if I’ve got dogs, pets, and I can also have.dog and I can also have.cat and dot cats and dot feline and.it creates this kind of not noise, but it, it definitely forces users to think about domains and sub domains in a very, very different way.

[00:21:25] So I think everybody’s going to have, especially in the, in the traditional domain community is going to have to reset. And I would go as far as to say that. You know, if handshake and other decentralized naming systems become prevalent and common, you know, in the, like the five-year period, actually it could signal some of the, the destruction of value in the.com domain network feel the same.

[00:21:48] Yeah. So, I mean, this is actually in some ways an existential threat and a battle cry from the decentralized community to the traditional domain community. They should be on watch because you know, you don’t own like these kind of big domains anymore. Now anybody can buy a domain. Yeah. And then the fees keep going up.

[00:22:07] I mean, the.com I think is going up again in September, I heard I’m also not totally into domain domain investing space, a more internet marketer, SEO, or, but of course I follow a little bit. And then the.org, I think a lot of people were upset about.org. You know, the. I don’t know if you know that I don’t want to say totally incorrectly, but the previous president or somebody in, I can laugh to start an investment company and then tried to buy.org in any, the whole plan was just to extract more value.

[00:22:36] In my opinion, is just increased, increased the cost of renewals, insider sweetheart deal kind of thing. That’s important. Who knows how much of that is true, but. It just goes to show that, you know, it’s like FIFA or like, you know, the, the IOC, the Olympic committee, like when you have these like global massive, you know, bloated organizations, they’re just subject to at best inefficiency and at worst, like kind of influencing corruption, like you see it over and over and over again, look at the UN like, you know, any international organization suffers from this and I can, is no exception.

[00:23:11] So handshake is, is a defense against this. Totally agree. I totally agree. So then, Do you see like auctions come? I mean, you know, of course I think back to your, like, am I, I see you almost kind of hosting an event where there’s these like investors, and then we have like an NFT auction of collectibles.

[00:23:32] Are these handshake names, is that, can you see that in, in the future? Like, I, I mean, maybe it’s maybe already doing that or seeing that, I mean, I can see this kind of like social kind of like. Eh, investor, you know, exclusive kind of club where people are like buying and trading these like, yeah, Mike, we should just do this.

[00:23:52] Like let’s, let’s do handy con let’s do it. Yeah. I’m I’m open for sure. Virtually we’ll do like a bunch of clubhouses. I literally just thought like, yeah, why not? I mean, I think candy con is a good thing. Well, let’s, let’s ask a Tisha and an English to sponsor and let’s do it. Yeah. Okay. I’m here one day.

[00:24:12] Let’s do it. And frankly, this is exactly how nifty started. I was, I was, I was going to sleep. This is like 2018. I was going to sleep. We had invested in the central land and I was like, I read an article that. I think it was about ether Mon or something had done was doing NFTs into central. And I was like, so I, I was, I literally got out of bed.

[00:24:36] I called Ari, who was the co-founder essentially. I was like, how come nobody’s doing an NFT conference? He was like, I don’t know. I was like, all right, we’re going to do one and we’re going to call it nifty. And so that’s where the name nifty came from. It’s from, it’s a play on NFT, obviously, but that was, that was where all it all came from actually.

[00:24:53] Okay, so this will be the nifty of handy. Penny candy con I don’t know. We got checked the names available. Sorry, auction. Maybe, maybe we just call it handy. Yeah. All right. Yeah, let’s do it. I’m all about making things happen too. So that’s great. Okay. All right. What we’ll do we’ll we’ll announce it and then we’ll figure it out.

[00:25:13] Okay. That social pressure, man. Yeah. I mean, that’s great. I think if we announce it, then there will be a lot of people in the handshake community who will volunteer. That’s fine. For sure. I agree. I’ll definitely push let’s make it happen. Done, done. So some things about NFT is so I, I did some research a little bit, you know, honestly, I’m more like internet marketer and somewhat crypto, somewhat, you know, e-commerce and trading.

[00:25:36] That’s kind of me. And so I learned about handshake. And name based in October of this year. And I’ve been addicted, like seems like, you know, you’re a big believer in it and it seems like it’s very addicting, honestly, but I started studying about NFTs of course, for this interview a little bit. And just, just generally it seems like it is even more hot topic, but they say the real value or the most important part is not just to NFT, but the blockchain, the NFT is like, I think you had said earlier, like verified on or, uh, authorized by, right.

[00:26:06] I mean, is that. Something you say like Ethereum, they always say Ethereum and Tron are the, are the blockchains of NFTs, but then we have this handshake and now I don’t know how you feel like that all fits together or is, am I making even any sense? But it was a question I kind of wanted to ask. Yeah. Yeah.

[00:26:24] I mean, it’s a good question. So the question as I’m kind of interpreting is like, where is the best place for NFTs to live? Right. I think that like, Ethereum is hands down the best at the moment. It’s the, it’s the worst, but I think ultimately it’s the best. And the reason for that is because they have like the biggest mind share.

[00:26:48] They have the most developers, they have the most applications and the broadest kind of adoption, both enterprise and retail. And so I think that that kind of confluence of resources is very important. For a vibrant, you know, that that’s like the, the fertilizer for NFTs Tron has a lot of baggage. I have to say, it’s not my favorite blockchain.

[00:27:10] It’s not my favorite community. And it’s not my favorite, anything basically. And I think that’s people don’t naturally kind of gravitate to Tron in the way that they. Gravitate to Ethereum or even polka dot for that matter. So nothing against Tron, it’s just not for me. And I think that while there is a lot of stuff happening there, I would personally prefer to see it, you know, go to Ethereum and others that said there are other, you know, ecosystems, like one of the products we invest in is called flair, flared up XYZ.

[00:27:41] So there are like a smart contract layer on top of. Other chains, which, which enables smart contracts, but like they’re famous that they, they started on top of XRP. So like XRP doesn’t really do a whole lot at the moment. And so they created a system to basically add smart contract function on XRP, but they’re also applying it to like LTC, to doge, to stellar, et cetera.

[00:28:03] And so they’re adding value to all these kind of dumb coins, dumb in quotations. So what’s interesting is that they are also mincing NFTs. And so a company called gala games who was started by one of the co-founders of Zynga created, you know, is actually moving his NFTs all over to flair. And so if they’re on flare, they’re completely compatible with Ethereum, cause flare is EVM compatible.

[00:28:32] And so I think we’re going to see like a lot of interoperable chains. But I do think that Ethereum will be like the kind of core of that. And there will be a lot of others who will inter-operate. So even, you know, I’m sure that polka dot will kind of take off at entities at some point as well, but because polka.is also interoperable or will be interoperate with Ethereum.

[00:28:49] Well, I think, I think Ethereum will still be the, kind of the, the main state, the backbone and things will branch off and inter-operate with it. Okay, thanks. That’s a really amazing answer. Thank you for all that insight. And then there’s of course there’s handshake. And then, I mean, some people even call these names and NFTs and themselves.

[00:29:04] I mean, NFT the name, the TLD. You have, is, is that, uh, could you call it and then there’s all these emojis, people going crazy about emojis. Somebody just bought another heart emoji, literally like an hour ago, I’m watching an assault on name base and you know, emojis. And then there’s other kind of like, I think it was 44,000 H and S just sold.

[00:29:22] Actually I know the buyer and in the community even S well, art emoji was already sold. I think it’s a different heart. Honestly, this is one kind of confusing thing. There’s these a different variation. Yeah. Yeah. There’s different emoji standards. Um, there’s that, but there’s also these other, like any, all these kinds of Unicode or puny code, you know, there’s, there’s different kinds of things like there’s chess pieces and there’s cards and there’s of course Chinese language, all languages, not just English, right?

[00:29:52] Every language has, are these. I mean, of course they’re meant to be a domain name, but. Some people are saying they’re more like an NFT collectable than a domain name. You know? I don’t know if you would. Yeah, I think that’s to be Frank, I believe they are. And in fact, we’re working on a project now to try and wrap NFTs, wrapped domain names into NFTs so that they are becoming collectible.

[00:30:17] So I think that it’s hugely important. I think that domain NFTs will become a thing like within a year. We’ll be, we’ll be handing out domain NFTs and I think emojis will be a big part of that. So yeah. All of these worlds are converging like handshake he’s gaming crypto device. Like I think that once NFTs are once domain names on handshake are wrapped in NFTs, you have the ability to collect them, but they become assets.

[00:30:47] And if they’re assets. Then you can connect with DFI. I think we’ll be able to collateralize yeah. Domains, wraps domains. And I think that it’s just another form of value. Right. Great. Imagine being able to get a loan on your domain name, like why shouldn’t you it’s it’s as valuable and in some cases, even more valuable than physical real estate.

[00:31:09] Yeah, there’s definitely in that domain space. They’ve been saying that for a long time. I believe that too, you know that for sure. Especially now with these lockdowns and you know, like less travel, you know, physical travel, like yeah. Online is even more valuable for sure. Yeah. We’re getting towards the time.

[00:31:24] I know you’re super busy and I really appreciate you doing this interview. So maybe we’ll start to wrap up a little bit of some takeaways. You know, somebody just maybe the first time they’re even hearing about. There’s, you know, it’s been about a year only handshake just turned a year old, the blockchain, and some people may mean just finding out about it.

[00:31:41] Now, what would you tell somebody, you know, The show go online, you know, in a week or so. So what would you say, you know, somebody should do now, you know, I guess get addicted to these auctions and start buying names or, I mean, of course it’s risky. Yeah, that’s it. I read a little bit, but just go and start buying domains.

[00:31:59] They’re collectibles. Like they’re fun. Domains are an expression of yourself. They’re an expression of your ideas. They’re an expression of like your interests. So just go out and buy. I mean, you don’t have to spend a whole lot, in some cases they’re free. Yeah, nobody else wants the domain. You’re bidding on it’s free.

[00:32:13] Congratulations. And you own that like forever. So you sell it. So it’s an extremely low barrier to entry from a financial standpoint, it’s a little bit of a hassle the first time from a kind of technical standpoint and just, but name based makes it super, super easy. You all you really need to do is go to name base.

[00:32:35] You can buy handshake token, which you need to use to buy the, the domains. You can buy handshake with a credit card name. This has your account. You can search for a domain. If your domain is taken, you can make an offer for it. If your demand is not taken, you can bid for it. And that’s it. You can get up and running in five minutes.

[00:32:52] So the best way to learn handshake is to be enhanced in a shake. And it doesn’t require a whole lot of, you know, practice. It doesn’t require a whole lot of like, you know, kind of insight. It’s not rocket science, it’s, it’s it’s playground stuff, but it’s fun. It’s fun. collecting is just a natural instinct of humans.

[00:33:11] Like we collect stuff for like, you know, birds with shiny objects. And I think that, you know, domains is just another expression of that. So I encourage everybody to go out. Find your domain, just buy one or two and have fun with it. And who knows, like you could potentially flip it for know, thousand X, like other people have.

[00:33:29] I know that, I think the guy that bought the domain initially of the NFT domain, I think he only bought it for something like, you know, a few thousands, 4,000, yeah, 4,000 handshake. And I can’t remember what the calculation was, but it was, it was something like. Several hundred thousand a handshake because what I paid for it, uh, the equivalent.

[00:33:52] So yeah, actually seven, depending of course the rates change, but they say at the time of the deal is about 680,000 HNS or 84,000. Yeah. So some for that, some from 4,000 to 680,000, I don’t even know what multiple that is, but it’s like something like. Yeah, 2000 X or something like that, so, yeah. Yeah. Yeah.

[00:34:14] Well, Ryan, I know I will actually get them on the show too later, but yeah. He’s yeah. Yeah, he’s a really a young guy and, uh, you know, super helpful in the community too. So it’s great. It’s great to have these stories and it’s great that you’re you’re yeah, I mean, you’re really active in the whole crypto space and since 2013, and it’s great to have you supporting this, this handshake, and it seems like it’s picking up steam more and more.

[00:34:37] I mean, we’re seeing more traditional domain investors getting into it. We’re seeing other people in Bitcoin getting into it. So literally it was just on a clubhouse and Nick Carter. I don’t know if you know him. He got his name into. He’s good. He’s trying to bulk buy HNS literally he was asking on clubhouse, if anybody has bulk HNS to buy.

[00:34:58] And it’s kind of like getting crazy now, but it’s exciting times for sure. Yeah. I’m going to, I’m going to out. I’m going to out Vinny Lingham too. So I think he has been pretty public from the founder of civic and one of the. Original partners, the multipoint he’s been like, we’ve been having great conversations about it, about a handshake.

[00:35:16] You should get him on the, on the show too. I, yeah, I’ve seen him in some calls. That’s awesome. Okay. Well, I think, I think that’s all for an album for it. I haven’t really enjoyed us. Like we can go on for a long, I know you’re super busy. What’s some, what’s some ways people can, we can link it up in the show notes or people will find more about, you know, what you and your businesses are doing.

[00:35:37] Yeah. I mean, of course, if you’re handshaking enabled and you’re going through Puma browser, you can always find me at, at, at Dr. Han, I guess there’s no real thought. And you just put in jail, they put a Slack, they have a slash some people I even me are updating they’re updating their Twitter names to put their name slash so the slash is how people know.

[00:35:56] It’s like a handshake name. Nice. Nice. Yeah. So /jehan on a handshake enabled browsers, otherwise you can find me at, at collection. On Twitter or at Jehan Chu, although I’m just slowly migrating to that Twitter handle and we’re on LinkedIn. Yeah. Hit me up. I’m always open to talking about handshake.

[00:36:13] I can love it. Like I’ll be a bit too much. Yeah. I’m similar. Like it’s really consuming. A lot of my mind space. And we talked a lot of other people in the community and it’s very, it’s not just certain groups. There is developers getting consumed by this there’s investors. There’s marketers, I guess I’m more in the market or group, but we’re all getting really excited about it.

[00:36:31] So it’s, it’s an amazing thing. Shout out throughout too. We should shout out to, um, this website Niamey and Iami like, Oh cool. You can like, they’ll give you an appraisal of your domain name. Like that’s brilliant. So I’m, I’m. So that guy, like, I think that’s great work. So I use it, you know, I put it on my bookmarks.

[00:36:51] It’s like, yes, Stefan is a developer. I think he’s, I don’t want to, I think he’s German, but he’s he built that I’ve talked to him. It’s Mimi. N I a M i.io is IO domain, but he actually has a TLD too. So you could just do a Mamie D slash and I am I on a handshake, so yeah, we’ll link it up in the notes too.

[00:37:12] Right? Awesome. Awesome. Thanks so much, really. I really, really love to be on the show and then let’s make this conference. I’ll follow up. Let’s make it happen, man. Great. I’m serious. That’s good. Okay. In my mind, honestly. And then there’s somebody just put in a invested in there’s a development fund for handshake and somebody just put in 50 K.

[00:37:33] I don’t know if I’m right. I just don’t really, but I think just yesterday and he’s asking me what other things we can do and I think events. Would be perfect. There’s not really been an event yet. So you haven’t really made it a lot of announcements about this whole developers funds. Um, but you should be expecting some kind of news, some big news.

[00:37:50] I think about what some of us have been doing in the background, in the handshake ecosystem to try and, you know, add more long-term support for the, for the protocol, [00:38:00] all kind of crowd crop supported and community oriented. So stay tuned. Okay, great. This is awesome. Thanks so much. All right. Take care.

[00:38:07] Thanks for, for your time. Yep. Do you enjoy the global from Asia podcast? Do you enjoy what guests you see here? We’ve been doing these masterminds. We have our membership and we’re going to even work up in the bar. We’re bringing you on to the dWeb. So if you want to get out of the dWeb and GFA extension, we talked about in the interview, you can become a GFAVIP member and you’ll support the show.

[00:38:27] You’ll connect with other people like me in our private masterminds and our community. Get our online courses and you will also get a domain. Name on the dot GFA extension, where we will build out a profile for you and promote you within our community. So I think that sounds pretty cool. It’s a whole new thing and it’s totally decentralized.

[00:38:46] See you there, gfavip.com. Thank you so much. Thank you so much for sharing. Jehan. And I really appreciate you sharing with us that, that, you know, inspiration, I’m all excited. I’m jumping back and see the auctions now. So I hope everybody followed that. Maybe it was a little bit more advanced. We didn’t do it like a beginner on a handshake, but basically I do as its domain names on Dorando blockchain instead of on a traditional internet.

[00:39:12] And I can, yeah. I know it’s hi. Hi, early stage, a little bit high risk, you know, I’m I’m anything but a shell or a promoter. Um, the opposite I’ve maybe should have told you earlier, we actually made a forum in handshake, handshake dot mercenary. So we owned some mercenary extension in handshake. So you can totally free one, but you gotta know how to use handshake to log in and to post, but you can read it without that.

[00:39:37] We’ll link to that in the show notes. And we have, like I mentioned to interview GFA. With GFA, we have, we’re going to start to make social network profiles for our GFA VIP members. And it’s a very early stage. So we only took some that attended our Chinese new year mastermind session last week for that.

[00:39:55] And we will start to show that in our future episodes and content. So keep an eye out for that. We’ll also link to some of these, but it will be like Mike dot GFA. Rose dot GFA, that will be like the domain and it will be on a decentralized server and I’ll be a decentralized domain. So it’s pretty. Pretty cool off on the chain, off the chain, off the charts.

[00:40:21] And then, yeah, I mean, I’m going to work on this online event for auctions for a NFTs. Are these these domains. So that’ll be a fun one and figuring that out right now, I’m doing a central or after the interview. And then next week we’re going to have some more guests. I think we might do this weekly for a little while.

[00:40:37] And, I’m, I’m full into this. And I just thought, finally, I would bring this into our GFA community and we’re going to be bridging this more with the. Membership with promoting and building up profiles for members on the decentralized web for the GFA extension. I’m totally excited about that. And it’s the new internet, but it’s actually, I think the way the internet should have always been, I think it’s too much control by just a few huge internet companies that are monopolies that are, you know, whole holding hostage or identities holding hostage, our content.

[00:41:04] And it’s just not the internet that I want my kids to grow up into, to be honest with you. So it’s my duty, you know, and I’m, I’m, I’m investing more into this and I, I hope you’re as excited as I am. The next show is going to be really cool too. And that’s, that’s all I got for today. Thanks again for watching.

[00:41:22] And also skyinclude.com is a totally separate blog and podcast, not podcast, but YouTube videos I make about these tutorials Skye include.com or.sky include set up that sky include. Or search sky include on YouTube. You can find out five 50 videos. I’ve made the last couple months about this and I got the cool hat.

[00:41:42] The MBS Johnny will hook me up. Thanks, buddy. I hope you enjoyed this show. Let me, Oh. And then of course, subscribe on our iTunes. If you are on YouTube, Global from Asia. And I see you on the dWeb in dot GFA. Maybe we’ll move the whole podcast there one day, but for now we’re still on the old web. I don’t know.

[00:41:59] There’s no podcast. So is there’s totally, you can make it. There’s search engines coming now a couple of search engines. It’s we’ve got to rebuild the whole internet. All right. See you. To get more info running an international business. Please visit our website at www.globalfromasia.com. That’s www.globalfromasia.com.

[00:42:18] Also be sure to subscribe to our iTunes feed. Thanks for tuning in.

Podcast: Play in new window | Download

Subscribe: RSS