It wasn’t a long time ago when crossing borders was a far-fetched milestone for small local businesses. At that time, to be a player in the global trade arena, you have to be one of those multinational companies with established global network and ample source of capital and investment.

With the development of e-commerce however, even small businesses were presented opportunities for growth across borders. This is true in businesses established in developed and developing countries. E-commerce plays a very crucial role in pushing further and beyond, international trade.

The Need for a Common Language

The rise of many e-commerce platforms allowed businesses to take on a more sophisticated approach in doing business. The use of information technology provided ease of completing transactions between buyers, sellers, manufacturing companies, logistics and shipping companies, customs and all those that go-between.

Successful product delivery marks the culmination of a sale. It is therefore necessary for all the parties to the business transaction to have a common understanding of how the sale should go. This is the very reason why the International Chamber of Commerce (ICC), a firm committed to the facilitation of international trade came up with a common set of rules and guidelines. This language breaks the barriers that can hinder sales and exchanges in the global scene.

This set of guidelines, becoming the common language in international trade, is called Incoterms.

What are Incoterms?

Incoterms stands for international commercial terms. Each term is a three-letter code that pertains to the selling terms that the seller and the buyer agreed to. The selling terms as described include the tasks of each party, the costs and the corresponding party who will bear them, risks and responsibilities, logistics and transportation requirement and management from the originating country to the beneficiary.

The Incoterms clearly defines the responsibilities and obligations that will be borne by each party. Just by looking at the three-letter code, one can already have a clear picture on who bears what in a sale transaction.

Responsibilities and obligations

It is important that the responsibilities and obligations of the seller and the buyer for the delivery of goods, be predetermined. An agreement has to be reached before any delivery activity shall take place.

The main responsibilities and obligations being covered by the Incoterms are:

- Delivery Point

This defines in what point in the delivery process and time will the risk be transferred from the seller to the buyer. Will it be at the buyer’s place, while on transit to the port, at the port, on board the vessel or carrier, or at a designated place?

- Transportation Costs

Incoterms lay down the transportation costs that will be incurred and who will be required to pay them

- Export and Import Procedures and Formalities

There are a lot of export and import requirements that must be complied before shipping shall be allowed. There are duties, taxes and clearances that must be settled at export point and at import point. There are also documents that need to be accomplished and must be on hand ready to be presented before customs inspection. Here, the incoterms defines which party will arrange for the export and import requirement.

- Insurance Cost

The incoterms state which party shoulders the insurance cost to ship the goods. Except for a couple of incoterms, most call the insurance cost arrangement, negotiable. It shall be agreed between the buyer and seller.

The Changes Done in Incoterms

The new Incoterms 2020 have already been published by the ICC and will be in effect for a decade or until the end of 2029. The last revision to the Incoterms was published in the year 2010.

What were the changes done in 2020 from the Incoterms of 2010?

From DAT to DPU

The incoterm DAT (Delivered at Terminal) was renamed to DPU (Delivered at Place Unloaded). It was an act of simple renaming to cover the fact that goods can not only be unloaded at transport terminals such as airports, shipping ports or docks. Goods can also be unloaded at any point in the country of destination which has the facilities for unloading the goods such as warehouses or factories.

Option of the Bill-of-Lading to bear on-board notation (under FCA)

This option is explicitly provided in the Incoterms 2020 for maritime transport. Here, the buyer can instruct the shipping company or its agent to issue a Bill-of-Lading (B/L) on behalf of the seller but with an annotation of “aboard”, meaning on-board. This states that the goods were loaded on board the ship. The B/L is often used as a supporting document in a letters of credit transaction proving the delivery of the goods and to facilitate payment to the seller.

Different Transport Insurance Coverage for CIF and CIP

In Incoterm CIP, it is the obligation of the seller to take out an extensive transport insurance coverage as prescribed in Clause A of the Institute Cargo Clauses. However, the parties are allowed to negotiate and agree on a reduced insurance coverage.

In Incoterm CIF, the seller is under obligation to take out a transport insurance coverage of at least the minimum as required under Clause C of the Institute Cargo Clauses. This is common to bulk shipments where the cost of the goods are lower because of the volume. While that is so, the volume may impact the insurance premium as, in this case, can shoot up. Hence, they are allowed to take out the minimum coverage required. But, this doesn’t stop them to take out a more extensive transport insurance coverage if both parties agree.

Customs Clearance, Export and Import Formalities Clearly Provided

The responsibilities of each party in relation to carrying out the customs formalities and clearance and assuming the risks and costs, are clearly stipulated and provided in Incoterms 2020. For the first time too, the release of goods in transit was included.

Transport Security

There are two circumstances where the liability of transport security can be addressed – the transport of the goods from the originating country to the destination and the customs requirements.

Incoterms 2020

The previous Incoterms are made up of 13 terms. There were several that were taken down and few that were added bringing the Incoterms 2020 to 11.

Before we list down the 11 Incoterms, it will be good to know that the Incoterms are categorized into groups – two freight terms, Freight Collect and Freight Prepaid. They are further grouped into the mode of transport.

What is the difference between Freight Collect and Freight Prepaid Terms?

These two present who shall be responsible to pay for all the international freight charges. If you ship out your goods under a “Freight Collect” term, you will not be paying any freight charges as your buyer will collect and shall pay for the freight charges.

Freight Prepaid on the other hand, as the name states, freight is shouldered by the seller. It is the understanding that all freight charges are already pre-paid.

These terms must be clearly stated in your Bill of Lading.

1. EXW

This stands for Ex-Works or Ex-Warehouse. Under this agreement, the seller is considered to have delivered when it has made available the goods to the buyer at the seller’s premises or at another named place. The seller will not be responsible for loading the goods to a carrier. Clearance for export is also not needed.

It is the responsibility of the buyer to get the goods out of the seller’s premises or at a named place, load onto the transport mode, through the scrutiny of the customs and to the destination. The buyer therefore bears all the risk from the seller’s premises to destination.

2. FCA

Under an FCA or Free Carrier, it is the seller’s responsibility to deliver the goods to the carrier or to a person or firm chosen by the buyer, at the seller’s place or another place designated by the buyer. The obligation of the seller is considered fulfilled when the goods are handed to the nominated carrier or person that at that point already holds custody over them.

It is best to explicitly state exactly where the delivery shall happen and to whom as there is a transfer of risk from the seller to the buyer, attached to that point. If the buyer has not indicated the exact point of exchange, the seller may choose within the place or range agreed where the carrier or person shall take custody of the goods.

3. FAS

This is an incoterm for Free Alongside Ship. This therefore only applies to sea or inland waterway transport. Under this term, the seller is considered to have fulfilled his obligation to deliver the goods when these are placed alongside the vessel on the dock or in lighters or barges at the agreed port of shipment. At that point, the risk is transferred to the buyer, meaning, he will bear all the costs, risk of loss or damage to the goods.

Under this term, the buyer is required to carry out all the export formalities and procedures, directly or indirectly. If this cannot be done by the buyer, this term should not be used.

4. FOB

FOB is the incoterm for Free On Board which means that the obligation of the seller is to deliver the goods on board the vessel or that the goods have passed the ship’s rails at the chosen port of shipment. At that point, all the cost and risks are transferred to the buyer.

Export formalities to ensure that the goods are cleared for export, under FOB are undertaken by the seller. And, like the FAS, this applies only to sea or inland waterway transport.

5. CFR

CFR or Cost and Freight means that the seller bears all the cost and freight charges relative to the delivery of the goods to the agreed port of destination. While so, the risk of loss or damage and any additional costs that will be incurred from the time the goods have been delivered on board the vessel shall be borne by the buyer. That risk is transferred from the seller to the buyer the moment the goods pass the ship’s rail.

The clearance for export here shall be processed by the seller.

6. CIF

CIF stands for Cost, Insurance and Freight. This goes like CFR only that Insurance is an added feature. It is the seller’s obligation, aside from bearing the cost to deliver and freight charges, to obtain marine insurance against the buyer’s risk of loss or damage during carriage.

The seller negotiates for the insurance coverage, which may be the minimum coverage and pays for the corresponding insurance premium. Should the buyer desire a higher insurance coverage, they may do so in agreement with the seller or arrange on their own the additional insurance coverage that they desire.

7. CPT

CPT or Carriage Paid To means that the seller’s obligation is to deliver the goods to the carrier or person that it nominated at the named place as agreed by the parties. Also, the seller negotiates and pays for the cost of carriage to deliver the goods to the place of destination as agreed upon.

All the risks of loss of or damage to the goods including all other costs that will be incurred from the time the goods were delivered to the custody of the carrier shall be borne by the buyer. The risk therefore is transferred from the seller to the buyer at that point.

8. CIP

This stands for Carriage and Insurance Paid To which is an expanded version of CPT. In addition to the obligation of the seller under CPT, Insurance is an added coverage. The seller shall contract for and pay the premium of insurance coverage which can be the minimum cover required. This will not stop the buyer though from negotiating with the seller an additional insurance protection or to process on its own.

9. DAP

Delivered At Place – under this rule, the seller’s obligation is to deliver the goods at the designated place of destination, ready for unloading. The seller bears all the risk to deliver the goods at the named destination and undertaking of all the export formalities. The buyer in turn assumes the risk and cost of unloading.

It is also practical to specify or explicitly stipulate the point of unloading in the place of destination so it is clear where the risk is transferred from the seller to the buyer.

10. DPU

Delivered at Place Unloaded was formerly known as DAT or Delivered at Terminal. The seller’s obligation, under this rule, is considered fulfilled when the goods are delivered at the disposal of the buyer, after unloading, at the designated place of destination. All the corresponding risks in bringing the goods and unloading them at the place of destination shall be borne by the seller. It can be noted that it is only under this rule that the seller is required to unload the goods at the place of destination.

11. DDP

DDP stands for Delivered Duty Paid which means that the seller has the obligation to deliver the goods, ready for unloading at the named place of destination, cleared for importation with all applicable duties and taxes paid. The seller’s responsibility to undertake all customs formalities is not only on the export side but also for import. All export and import costs, duties and taxes therefore shall be paid by the seller.

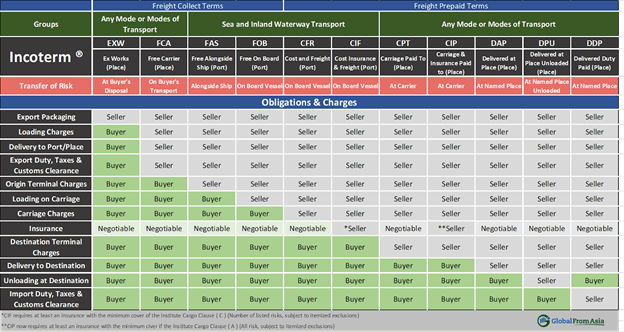

Incoterms 2020 Chart

For an easy look-up and easy to understand format, you can check the chart below. The chart shows at which point the risk is transferred from seller to buyer, the obligations and charges and which party is responsible.

Choosing The Best Incoterm

You cannot say for certain which among the 11 incoterms is the best. In choosing, you must consider a lot of factors. Say for example, who will pay for the shipping costs, what is the best mode of transport, what risks are the parties willing to bear, and other things that are related to risks, obligations and charges in the delivery of goods.

Before negotiating, you have to have chosen the incoterm that you think will be best for you. Then proceed with the negotiations with the other party. You just have to remember that the best incoterm is the one that both parties have agreed on.