Our recent blogs and posts have touched on the subject of the US-China Trade War. We discussed several times, the rising tariffs being imposed by the two countries on goods exported from and imported into between these countries. Entrepreneurs have become creative in their effort to cushion the effects of the rising costs of goods.

We covered in a previous post how importers get by US tariffs using Section 321. In this post, we will take a look at another legal loophole that got companies heading for Hong Kong.

First – Sale Rule

Like the Section 321, the first-sale rule is a tariff scheme that companies are now using to reduce their exposure to US tariffs. This applies to importers bringing goods in the US involving a multi-tiered transaction model. In this model, a product is bought and sold through multiple layers prior to its import in the US.

Under the first-sale rule, duties can be applied to the price paid at the very first sale from the manufacturer to the first wholesaler, for example, rather than to the final price paid by the importer that has already been marked up.

How Does the First – Sale Rule Work?

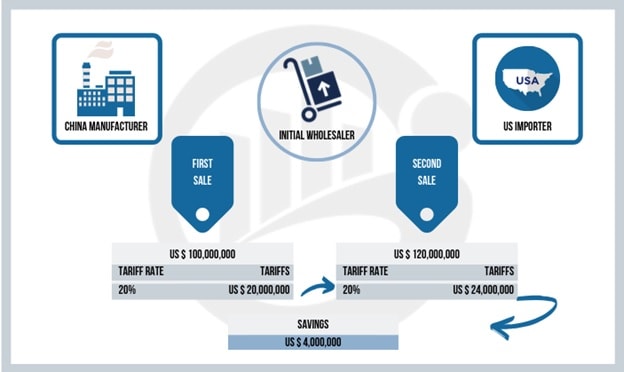

To better illustrate how this rule can allow importers to reduce their exposure to the rising US tariffs, we take for example the case where a manufacturer in China sells to a middleman or the initial wholesaler in Hong Kong for a price of $100 million. This will be considered the first sale before it reaches the importer where the price is marked up to say, $120 million. Assuming a 20% tariff rate, the tariff shall be applied to the price based on first sale or $ 20 million instead of $ 24 million, if based on the price on the final sale.

In this scenario, the importer is able to reduce customs duties and generate considerable savings. Other major markets such as the European Union have placed restrictions on using the first-sale rule but the said rule remains valid in the US.

Why Go To Hong Kong To Apply The First – Sale Rule?

You might be wondering that if this rule is a universal trade law then what makes Hong Kong the preference of most importers?

Aside from the fact that shipments to Hong Kong from Mainland China cost less than when you ship to other Southeast Asian countries, the city, having the status of a free port, does not impose customs duties and taxes on imports.

The Hong Kong Trade Development Council does business matching between companies and the experts on the First – Sale rule which clearly indicates that its use is approved by the government.

What It Takes To Apply The First – Sale Rule

This rule has long been in existence but its use has only grown in popularity when US imposed increases in tariffs in line with the US-China Trade War. While it can generate huge savings for the importers, the effort is nothing short of exhaustive. Documentation is voluminous and the process has to be done manually.

The importer must be able to show proof that the first price is correct. To be able to prove this, your suppliers or partners, by virtue of transparency must disclose data or information that may be too sensitive or confidential. This could be financial data that Chinese manufacturers do not generally share. It also runs the risk of errors, especially since the process is done manually. Errors can be considered negligence on your part and can be subjected to a fine.

Eligibility as a First-Sale Transaction

Compliance to the documentation does not immediately guarantee your importation as an eligible first-sale transaction. You still have to satisfy the following requirements:

1. There must be two bona fide sales.

This means that the same company or party must be the buyer in the first-sale when purchasing from a manufacturer, then the seller in the second sale when it goes to the ultimate importer.

Documents to prove that the sale is bona fide may include purchase orders, bills of lading, sales contracts, sales invoices, messages and other exchanges, and company reports.

2. The products are meant for export to the US.

Even at the instance of first-sale, it must be clear that the products are destined for export to the US. It is the US customs that determines this based on documents such as but not limited to: production orders, customer specifications, samples of logos, labels and barcodes, warranty cards, and other certifications for the sale of your products to the US.

3. Manufacturer or supplier and the initial wholesaler or intermediary are not related.

The relationship between the supplier and the intermediary at first-sale must clearly indicate independence from each other or they do arm’s length transactions. Meaning, one profits from the sale. The pricing must be in accordance with the industry trends and practices.

A Risk Worth Taking

Like any other effort to ensure sustainable and profitable operations, the application of the first-sale rule comes with a price. While the autonomy of Hong Kong in its legal framework and tax policies under the “one country, two systems” arrangement has been obscured by the recent rounds of protests against the extradition bill, importation to the country using the first-sale rule increased drastically this year.

Even if the time and resources needed to apply the first-sale rule are too significant and cumbersome, the uncertainty of the end of the US – China Trade War may make the effort, worth taking.