Note: This is more on the corporate setup side for a HK company and Amazon sales. Check out our how to guide on how to get started selling on Amazon FBA internationally for the business side of it.

Getting Started Selling on Amazon

There are massive courses written on how to sell on Amazon. This guide is focused on setting up your account from Hong Kong, but we also give some general tips on Amazon FBA selling in general to start.

It consists of two parts, 1) Finding a good product and 2) optimizing your Amazon listing once its listed.

Here are a few tools many Amazon sellers use, here are a couple our readers discuss:

- Jungle Scout – One of the first and most diverse collection of Amazon seller tools out there.

- AmaChete – a newer, more affordable tool for Amazon sellers.

Try out one that works best for you – to dig through the massive amounts of data to find products that have a good opportunity for you.

Setting up your Amazon business especially from scratch would entail all of your time and effort. You need to evaluate, assess, research and study.

What do you need to do first? What are the things to comply? Where should you go? These are common questions that can make you feel overwhelmed at the start. Then you also have to factor in how to grow and scale your business. It’s tough work.

These are just some of the reasons why it would be best to seek help from the experts. You can hire a full service agency to scale your Amazon FBA Business. You don’t need to do it alone.

Easy To Buy From Chinese Factories

Hong Kong is where everyone setups up their business for their import and export business. It is right next door to Mainland China, without the complexities and headaches that you’d get in the PRC.

So your Chinese factories, many of them, will already have a HK company and a Hong Kong bank account, most likely HSBC HK. You can pay them immediately, no fee, and they will receive the funds almost at the same time.

You can envision one of those drug deals in the movies, or hostage situations. One side brings the “goods” (drugs, hostage, etc) and the buyer brings the cash. Well, in more modern action movies, it’s not a suitcase of cash anymore. Instead its a laptop or a code that sends the funds to their bank account with the press of a button.

Not to correlate drug dealing and buying from factories, but you can be inside their factory for the deal. You finish doing a quality inspection, and whip out your HSBC Hong Kong online banking afterwards. Show them you transferred the funds (spin the laptop around and show the screen). Also you’ll have a reference number on the spot. They can check that same instant. They confirm the funds received, and they let the container ship leave the factory dock.

If you do this from an overseas bank, it would at least be 24 hours or so, and much higher fees. Are you buying from many factories and doing a lot of factories transactions often? You can save a ton of time, fees, and headaches by having a HSBC HK bank account.

Low or Zero Percent Tax

The corporate tax rate in Hong Kong is 16.5%, which is low already in the global index. On top of that, if you can prove you’re an offshore business, you can get a 0% exemption on the earnings you make outside of Hong Kong.

If you’re selling in Amazon USA, then, that isn’t Hong Kong right? Enjoy this offshore tax while also being in a great jurisdiction like Hong Kong. This way you can enjoy the legal protection and corporate image. Best of both worlds.

Amazon Has Overseas Sellers Programs That Make It Easy

Amazon allows sellers from around the world to sell in the Amazon USA marketplace. And now that you can piggyback off their fulfillment operations via FBA (fulfillment by Amazon). No longer do you need the headaches of a warehouse and logistics center in USA.

Buy your products from the factory in China, pay from your HSBC HK bank account, and ship them direct to the Amazon FBA warehouse in America.

Once the sales start to come in, Amazon pays out the sales proceeds every two weeks. Get an account with Payoneer and have the funds sent direct to Hong Kong. Nice and smooth.

Don’t get left behind with others who have more complex business operations. Take it from me, e-commerce was a lot, LOT harder ten years ago. Nowadays, you don’t even need a website, just load up in Amazon and get the sales payments twice a month.

Credit Card + Phone Verification

We have gotten a lot of attention from Amazon entrepreneurs going through the HK setup process, and a good question we received is below:

A problem I see is they’re asking for an international credit card (which my HK company does not have- just UnionPay). How did you do it? some of their support articles and comments from people on the internet seem to indicate they need to verify that you have a phone number in HK too.Alvaro

Can Grow Into More Business Opportunities Later

This is why we suggest people to apply for a credit card at the bank – the same time they go in for a new account opening.

Phone number, people use online numbers like Skype in.

Selling on Amazon is a great business. Lots of people are making good monthly income from. But maybe once you get the sales coming in and the business running, you want to try something else.

No problem, you can leverage the power of this Hong Kong company for your new venture too! You can apply for the many merchant account options and get that connected direct to your Hong Kong business bank account. Open your own shopping cart and pay direct via Shopify or another cloud based shopping cart.

Can You Sell on Amazon USA with a Hong Kong company?

Yes, this is possible. You register your Amazon seller account with your Hong Kong business registration certificate. It will ask you a million and one times if you are American or not. You need to be a non-American to do this – legally. But for those non-USA citizens, this is a great way to connect your Amazon USA sales to your Hong Kong business.

You can then have Amazon send money to your Payoneer or World First account and then receive the funds in your Hong Kong bank directly. With the funds in Hong Kong, you can then directly wire money to your Chinese factory. Often times they have a Hong Kong bank account, such as HSBC, so there are no fees and the transfer happens within seconds.

Talk about fast and efficient! This is pretty close to F2C (Factory to Consumer) – you can also read up a blog post where we discuss F2C

If you want to get more insights from the experts on how to run your Amazon FBA business from Hong Kong, its pros and cons, then check out this interview with Peter Luxenburg:

Will I Receive USD or HKD (Hong Kong dollars) from Amazon payments?

The next most popular question is what funds you will receive. Most think they must receive Hong Kong dollars and get hit on the foreign exchange (FX) fees. But there are other options. We discuss this a lot in our member’s forum for client.

Here’s an interesting answer from one of our clients:

There are a couple of companies that can keep your money in USD and have way lower fees than Payoneer. We are looking at OFX right now and also World First. OFX has an office in HK. Looks like that is what we will do. And then link to Hk bank account once we have itGFA Client

Many of our clients have also been using Remitsy as a way to get money into China successfully while banking is pending.

Of course, these policies and fees are always changing, so best to ask these service providers.

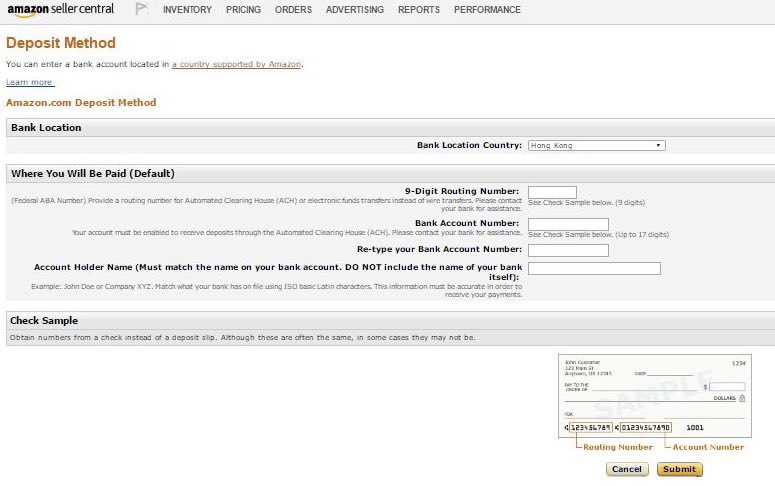

Connecting HSBC HK to Amazon

After a lot of chats with Amazon seller support, my contact was able to connect his HSBC Hong Kong bank directly, simply by choosing Hong Kong and then using the above trick to get the account number to fit. Others please help update me.

While there have been people saying that Amazon won’t wire to Hong Kong – I have had readers (as of October 2016) tell me that they can add their HSBC Hong Kong business bank account to their account directly.

No 9 digit routing — and few people online say dont use first 3 of the 12 number of your account (say 1st 3 numbers are bank not account number)

Doing Your Amazon FBA Bookkeeping

So once people get the Hong Kong company setup for their Amazon business, they then ask how do they best balance their accounting books? While there is no difference in bookkeeping for an e-commerce business as there is for any business, there is a setup that many sellers have been using.

This is called A2X Accounting – it is a plugin on top of Xero software that connects automatically to FBA’s database and imports all your sales numbers in. This way you can save time from data entry as well as worrying about “fat fingers” and other issues with humans.

Fulfillment Centers in Hong Kong

With a seller’s account in place, a marketplace and products identified, the next question would be, where to store inventory for shipment. This is exactly a question sent in by one of our readers:

“We have a European Amazon account and would like to store our goods in Hong Kong FBA but am unable to find the correct link. Could you email how we can store our goods in Hong Kong for shipment to Europe?”

It’s an information worth sharing so instead of a private email to the sender we opted to add this to the blog for everyone to know.

Storing and shipping your products are now made easier through fulfillment centers. Any Amazon seller would know what these are. The logistics process is as simple as ABC:

1. Send your products to the fulfillment center

2. Fulfillment center stores products locally

3. Your customers buy your products

4. Fulfillment center picks and packs purchased products

5. Fulfillment center ships the products

In Hong Kong, you can store your goods in the following fulfillment centers:

DHL Hong Kong

This center opened in year 2017 to keep up with the demand for cross border e-commerce. It is located next to DHL’s Interlink warehouse in Tsing Yi Island, hosted in its megahub.

Services offered:

High quality fulfillment services and SLAs

Receiving handling and putaway

Quality check

Visibility & tracking of inventory

Order handling

Pick & Pack services

Packaging materials and supplies

Returns handling

Value Added Services (e.g. lot and serial number tracking, kitting packages)

Also, be aware of the delivery lead times of DHL:

Domestic – STANDARD: 2-3 days

Domestic – EXPRESS: 1-2 days

International – STANDARD: 4-14 days

International – EXPEDITED: 4-8 days

International – EXPRESS: 1-4 days

Business Address: Tsing Yi Island, near the Hong Kong International Airport

Contact: +852 2400 3388

Email: fulfillment@dhl.com

Easyship

This was launched in Hong Kong in the year 2014 as an online logistics platform that connects sellers to various couriers. It has expanded its reach globally with warehouse partners in Singapore, Australia, USA, Canada and the Netherlands.

It has over a hundred shipping options with up to 70% discount; an easy to navigate shipping management dashboard where you can manage your inventory and monitor its sales performance all in one place; easyship calculator so you will know the correct shipping costs to charge your customers; full commerce integration for e-commerce platforms such as Alibaba, Amazon and Shopify; can cover B2B and B2C shipping; and it also offers same-day dispatch.

Services offered:

Storage

Pick and Pack

Shipping to your clients

You can read our in-depth review on Easyship here

Business Address: 20/F, Hua Fu Commercial Building, 111 Queen’s Road West, Hong Kong

Contact: +852 3008 3991

Visit their website here

Floship

This company, founded in the year 2015 in Hong Kong, is another eCommerce fulfillment platform and shipping services that is integrated with many eCommerce platforms such as Magento, Shopify, WooCommerce and Amazon. It offers end-to-end solutions for cross border eCommerce businesses that demand shipping globally. It has warehouses in Hong Kong and in Mainland China

Services offered:

Storage

Order fulfillment

Returns solutions

Last mile delivery

You can read our in-depth review on Floship here

Business Address: Unit 1102, Tower 2 Ever Gain Plaza, 88 Container Port Road Kwai Chung, NT, Hong Kong

Contact: +852 3706 1612

Visit their website here

Global EXchain

This company is under China’s SFC Services Limited that began as a software development company in the year 2001. In year 2007, EXchain was established with the direction of going non-traditional in logistics and focused only on e-commerce. Having been in the industry for several years gained this company extensive experience in Fulfillment and Warehouse Management. Its warehousing network spans from Hong Kong, China, US to Germany.

Services offered:

Warehousing

Quality Inspecting

Assembling

Packaging

Outbound Shipment (from Hong Kong to overseas)

Inbound Shipment (Hong Kong to China)

EXchain offers various e-shipment options as provided below:

1. Dedicated Lines

Europe

Delivery takes 4 to 12 working days

Covers around 40 European countries

Maximum package weight of 30 kgs.

Custom clearance done in the UK, no secondary clearance needed

Australia

Delivery takes 5 to 8 working days

Anywhere in Australia

maximum package weight of 20 kgs.

Provides online inquiry service on the parcel delivery

America, France and Russia

Delivery takes 7 to 10 working days

maximum package weight of 2 kgs.

Provides online inquiry service on the parcel delivery

Europe Express Class I

Small packages can be delivered worldwide

For Europe, delivery period takes 7 to 10 working days

For other delivery regions, 7 to 20 working days

Divided into Class I surface mail and Class I registered mail

maximum package weight of 2 kgs.

Custom clearance done in the UK, no secondary clearance needed

Minimum size 9 x 14 cm.

Maximum size: Length + Width + Height should not exceed 90 cm. For single width, should not exceed 60 cm.

Europe Express Class II

Parcels can be shipped to over 20 European destinations

Takes 6 to 12 working days

Divided into Class II surface mail and Class II registered mail

Custom clearance done in the UK, no secondary clearance needed

2. International Post

Hong Kong Post

Air mail service for shipping small items

Takes 7 to 20 working days

Maximum weight of up to 2 kgs.

Volume Limit: Non-cylindrical package: length + width + height should not exceed 14cm; for single width, should not exceed 9 cm

Cylindrical package: twice the diameter + length should not exceed 14cm, width should not exceed 9cm; For cylinder package: twice the diameter + length should not exceed 17cm

Singapore Post

Includes surface mail and registered mail

Takes 10 to 30 working days

Maximum weight of up to 2 kgs.

Electronic devices can be delivered

3. International Express

Covers USA, Canada, Mexico and Europe and delivery period takes 3 to 8 working days:

Economic Express

DHL

Business Address: Unit B, 24/F, Excelsior Building, 68-76 Sha Tsui Road, Tsuen Wan, NT, Hong Kong

Contact: (852) 3565 5738

Visit their website here

Shipwire

Shipwire is a global fulfillment center and a brand operating under the Ingram Micro Commerce & Lifecycle Services. It provides supply chain solutions that supports the e-Commerce industry. It boasts of its access to over 200,000 commerce connections and 154 advanced logistics center in 45 countries.

Its warehouse in Hong Kong is a gated facility with 50,000 sq. ft. in space, located within 40 kms from Hong Kong International Airport.

Services offered:

Custom packing lists, invoices and labels

Custom packaging

Marketing inserts and samples

Relabel and repack

Kitting and virtual kitting

Branded customer communication

UCC labeling, tamper seal labeling and ticketing.

Virtual kitting, bundle packaging and subscription box kitting

Product inspection, cycle counts, ASN assistance and serial scanning

Cross-dock or stage shipments.

Retail partner management, retail-ready product and display builds

Light photography

Business Address: 3/F, Goldlion Holdings Centre, 13-15 Yuen Shun Circuit, Siu Lek Yuen, Shatin, NT, Hong Kong

Contact: 1-888-SHIPWIRE

Email: info@shipwire.com

Visit their website here

V Logic

This company was founded in the year 2000. Its flagship fulfillment centers have a total area of 200,000 sq ft spread across strategic locations within Hong Kong.

Services offered:

E-commerce and E-Fulfillment

Warehousing and Order Pick & Pack

Inventory Management

Value Added Services

Local and Worldwide Distribution

International Freight Forwarding

Value added services:

Label printing

Labeling

Retail price tagging

Promotional inserts

Kitting

Gift wrapping

Shrink-wrapping

Blister-packing

Customer specific packaging

Customer specific quality inspection

Sourcing

Business Address: Room 1003-5, 10/F, Phase One, Modern Terminals, Berth One, Kwai Chung, New Territories, Hong Kong

Contact: (852) 3102 3088; (852) 3101 0121

Email: infohongkong@v-logic.net

Visit their website here

If you know of any other fulfillment center in Hong Kong, please let us know so we can add to the list and keep this updated.

What Do You Think? Ready to Leverage Hong Kong for your Amazon FBA Business?

So I know how stressful it is when structuring your corporation. Or even more stressful it is to restructure and close down a company and move funds and assets to another. But that is the only way we grow and stay competitive.

I’d love to hear any and all comments. Maybe you don’t agree – please share! You should be at a certain level to maintain the upkeep costs of an international business. And also able to come to Hong Kong at least once for the bank account opening. We offer services for Amazon sellers and online business owners who aren’t in Hong Kong to make the process as simple and smooth.

If you like this article and blog, we’d be ecstatic if you’d consider our HKVIP Hong Kong registration package. We will take care of everything from A to Z. We work with a lot of Amazon sellers and will give you pointers and tips we have seen along the way.

Even one of those tips during the setup process could save and make you thousands of dollars, so we hope to see you soon!

Related: Check our full Amazon FBA library for more guides and tools.

Connect with a Hong Kong Business Rep

Ready to get your Amazon FBA business setup in HK? Then look no further, fill out the form on the next page and our client services representatives will be in touch with you shortly.

58 Comments on “Is Hong Kong Right For Your Amazon FBA Business?”

Pingback: Selling on Amazon USA with a Chinese or International Company with Wilson Blues - GFA96

Good review, Michael. What I’ve found is the Payoneer part turns a number of people off. They find it easier to be in the US or EU and set up tax-friendly structures rather than using third parties to get paid by Amazon. The China connection definitely makes sense, though.

hey Andrew,

thanks for reading and commenting! True, there are a few people who ask me how long , how stable will Payoneer be for payouts. There are other alternatives too I’m talking to in case Payoneer doesn’t work out though.

Hi Michael, the set up looks fantastic. My question is after everything set up in Hong Kong, how to ship the products to the amazon warehouses?

Hi Paulo,

Shipping products to Amazon is the same process here as anywhere – send from Chinese supplier directly, or whichever supply chain flow you want. no need to ship to Hong Kong first, if that is what you’re asking.

But since I posted this – HK banking has gotten very difficult, so this is something to be aware of.

Thank you Michael. But does these Chinese suppliers ship directly to Amazon FBA? They will handle the customs? I’m thinking about starting, but my afraid is on US customs.

hi Paulo,

there are Amazon FBA logistics specialized companies that can do that for you

Thanks a lot for the tip. Will dig into it.

Anyhow, the importer of record to clear your goods coming into any USA port is require. And Amazon is not going to pay the US Import duty, HMF, and MPF tax on your behalf.

Pingback: Go Factory To Consumer (F2C) from China via e-commerce with Wilson Blues - GFA66

What is the tax structure implied with this setup? You register on Amazon global, fine. As a foreign (HK) entity, Amazon will ask you to fill a W-9 or W-8BEN form. If you are NOT a US resident in the first place, what will be the end result? For instance, as a EU company wanting to operate on Amazon US, unless you have EU VAT and declare in the EU your US revenue, Amazon US will NOT ONLY withhold 20% on your behalf the equivalent EU VAT on the gross Sales price, BUT ALSO apply the same 20% to the monthly fees (=you’ll pay $47,99 instead of 39,99/month) AND each and every Amazon fee (including FBA) will be also bumped up 20%. That is not a viable plan. What happens on using a HK setup instead?

Hi PAD,

I’m not a global tax professional so I am hesitant to give definitive comparisons of EU and US tax laws. But as far as EU people I know doing this setup do not have the VAT added in US as they are in HK not in EU.

This is just my thoughts.

If your company in in HK and you sell in the USA, then EU tax or laws would not apply as the legal entity is in HK, and the actual operations (products sold) in the USA.

Plus, In the EU, the VAT rate is different from country to country. For example Denmark is 25% and France is 20%, so not sure how that would work. Maybe someone knows?

Mike

http://www.virtualstaff.ph

Hey Michaele,

Great article. I knew about the Hong Kong part, but for a non-us Citizen or Resident who doesn’t live in the U.S. Even though you have Hong Kong Corporation and your income is generated in the US (Outside Hong Kong, meaning 0% tax in HK). Do you still have to pay Federal Income Tax in the US? I ask this because the US doesn’t have a tax treaty with Hong Kong. Can you confirm this please?

“Do you still have to pay Federal Income Tax in the US?”

Yes, if the income is generated from US sources, then US Federal income tax is owed on it.

Hey David. “Yes, if the income is generated from US sources, then US Federal income tax is owed on it.” If that is the case then What is the purpose of opening a HK Business. Just Create a LLC in the US, you’ll pay taxes anyway.

Here’s an excerpt from an US Tax Attorney:

“If you’re NOT a US citizen or green card holder, the situation is entirely different. Here’s how it works:

A non-US person is subject to US tax on business income only if they’re “engaged in a trade or business in the US” (or “ETBUS” for short). A non-US person is ETBUS only if two things are true:

They have at least one employee or dependent agent in the US, and

That person does something substantial to further the business (not just something administrative or ministerial).

Amazon is not an employee or dependent agent of yours, they’re an independent agent—they have their own business going on, and you’re simply a client. So, just selling stuff on Amazon all by itself would NOT make you ETBUS.

So, here’s the bottom line: If you’re not a US citizen or green card holder, and you haven’t hired an employee or independent contractor in the US to operate your business, then you won’t owe US federal income tax.”

more detail here: http://ustax.bz/how-to-structure-your-non-u-s-business-or-profession/

wow, this is amazing information Martin – thanks for sharing here.

I’ll try to clarify the situation to the extent of my knowledge.

1- If the entity doing business on AMZ USA is based/registered outside the US and you are not a Us citizen, you are not subject to Income tax in the USA (i am not talking about Sales tax which is a whole other matter). You are to pay Taxes in the country where your entity is registered. Now if your entity is an Offshore entity registered in HK, you are exempt from income taxes by HK tax laws.

There are more complications here people. Just because you have a Hong Kong based company doesn’t mean you escape US tax law. Even if you file for a W-8BEN or W9, this doesn’t don’t exempt you from paying local US state taxes. Just google FBA Amazon Seller Nexus Sales Tax and you will see what I mean. Also unless your company is registered in a US Tax Treaty country then you will have to pay double tax. The only positive for Hong Kong companies is that once you pay federal income tax to the US the extra cash that comes out goes to your Hong Kong business and then because your Hong Kong business is generating that money from abroad you wont pay any income tax, but you will still have to pay for local and federal tax within the states.

“because your Hong Kong business is generating that money from abroad you wont pay any income tax”

Completely incorrect. The HK business’ income from operations would have to qualify as non-Subpart F income in order to be eligible for *tax deferment* with respect to the US citizen owner’s tax liability. For non-Subpart F income, US taxes are simply deferred on this income until it is paid to the US owner and/or repatriated to the US.

Any Subpart F income, and all passive income (capital gains, interest, etc) of the foreign/HK corp do not qualify for tax deferment, and thus is considered income of the US citizen shareholder(s) and fully taxable as it accrues.

The rules regarding Subpart F classification are labyrinthine in complexity, and hiring a well-versed CPA to navigate it is highly recommended.

There is more complication if you are a US citizen only . If you are not a Us citizen it is as simple as No income tax for your offshore company based in HK ( look into compliance to be qualified as Offshore in HK).

Does Amazon require the personal information on the company director or share holders or is the Ltd company details all that is required?

Would be great to know more about the sign up process from someone who has done it for a HK company.

I have gone through some steps with HK friends and it asks if any of the owners are Americans (a shareholder over 10%) – and if you say yes – it kicks you back to the start and says fill it out as a USA company or US individual.

Hi Michael, In my case none of the owners are US Individuals. Do you know if it still asks for the persons details?

Thanks,

yes, any application needs to know the owners of the company, at least the active owner / director – whether its Amazon FBA, or a loan, or anything where they want to know if this company is legitimate or not. Cannot hide behind a company when applying to something- the business needs to have humans behind it. Hope this is clear?

Having a HK company gives you ZERO TAX BENEFIT if you are an Amazon FBA seller, as HK has NO TAX TREATY with the USA.

SO you are doing business in the USA (because you have inventory stored there), what this means is that because there is no tax treaty, you are liable for company tax in the USA… you have to file your HK reports to the IRS, and you have to pay company tax to the IRS.

They will come after you if you don’t and there are data sharing agreements with the USA and HK.

If you were not warehousing in the USA (ie not doing Amazon FBA) – this is likely not the case.

Having a HK company gives you ZERO TAX BENEFIT if you are an Amazon FBA seller, as HK has NO TAX TREATY with the USA.

Is this also valid for non-US citizens?

Does someone know if Amazon would have problems accepting a Hong Kong company with a bank account outside of Hongkong, as for example Swiss bank account?

This is where you’d have to find payment solution providers like OFX, Payoneer, World First, Currencies Direct, etc. But they normally want the bank to match the country of your account.

Hi Michael, so being a non-us resident with a HK corporate allow me to enjoy 0% on a corporate level because I am not ETBUS in U.S therefore not liable for Federal Tax in U.S? Is that it?

Hi Lucas,

i’m sorry I’m not really feeling qualified to answer that question, I’d ask a US tax attorney.

Hi Michael,

I am a non chinese resident in HK. I want to start selling on Amazon FBA by sourcing some products from china. Can I do that without registering a trading company? as I want to test the waters first before jumping to a full fledged ecom business. Please let me know.

Thanks

Sandesh

hi Sandesh,

you can sell as an individual and use your HKID – but later you’d need to start a new seller central account if you register a company – so some just start with a company to not need to start a new account later, good luck 🙂

Hi Michael, thank you for the article. This comment is not entirely true. Amazon allows you to update your legal entity and tax information. In fact, starting a second account is prohibited without specific permission.

Does Amazon HK accept seller FBA accounts from HK companies owned by PRC Chinese citizens ? i have heard that Amazon HK does not accept?

Thanks

Peter

Hi Peter,

When/ where did you hear this? Regulations have been changing fast, but I do know of clients and members we work with who have HK companies and amazon Fba accounts

* Mainland Chinese clients / members

Nice article, learned a lot from it! I am a permanent resident from Hong Kong and live in Hong Kong. I am thinking to start an amazon FBA store, anybody interested in collaboration?

hey Michael! So happy you enjoyed the article- actually we are currently in application process for people to join a new Amazon FBA e-commerce busienss – want to read it and consider applying ? its here – https://www.globalfromasia.com/amazon-fba-incubator-case-study/

Hi

Michael, I’m thinking of something similar. U still around.

Hi, Michael

I have a golf company called selfieGOlf in California. I am already established in Amazon US, looking to expand to Amazon.CN. Are you still looking to collaborate?

Pingback: How to Start Selling on Amazon FBA, Internationally (The Definitive Guide)

May I know how to register Amazon US and Japan using a Hong Kong company? Can you introduce an Amazon Account Development Manager to me?

Hi Alex,

I don’t know these people either – you can simply file like the instructions we have outlined in the blog and go through the procedures. Are you having problems verifying your Amazon HK seller central account?

Have you shipped from Hong Kong directly to an FBA warehouse? If so, would you recommend Hongkong Post, or would you say to go with DHL/FedEx? Thanks!

I want to do FBA business with amazon.com and i am living in Hong Kong. I will be operate all thing form HK. Please confirm me it is possible or not.

It is very possible if you find a logistic service provide willing to clear the US custom for you when the goods enter into any USA port. The hardest part is to find a company to be the “Importer of Record”. Because it is needed in order to file a custom entry and pay import duty, HMF, and MPF tax before you be able to take out the goods out of a container or airport. After that all you need is any freight forwarding or trucking company to help you truck the goods to amazon fba warehouse that they request you to send your goods. I suggest you try to add the goods in your amazon account and print out all label in each unit and pallet before you ship to FBA or they will refuse to accept or charge you for pre-service for each item.

Hi Globalfromasia do you have a office in Hong Kong , and if yes then please share the address phone number and the contact person name so that we can visit and discuss everything in person.

Hi Bob,

Sure our address for corporate services department is on www.globalfromasia.com/contact/ ask for Ray Ng 🙂

I have a HK company, and we are trying to set up an Amazon account so that we can sell our products on Amazon USA. We are having problem with the Amazon seller identity verification, but Amazon won’t tell us what the problem is. We sent them everything they asked for such as Business Certificate and HK passport, and everything should match up. They asked for a bank statement as an additional verification, and they have suspended the account after that. Do you know what is wrong? Can we use a HK local bank, or do we need to use HSBC? Thanks.

Hi Anthony, please let us know if you were able to resolve the issue with your Amazon seller identity, or if you eventually found out what caused the problem?

Hi Anthony, I’m having the same issue. It’s very frustrating and amazon support seem unable to help. Did you manage to find a solution yet? Thanks

Hi Michael, great article.

I’ve been trying to set up an amazon US account via my HK company for some time but continually fail the identification verification. It’s as if they don’t recognise my business documents.

The only advice amazon support can give me is to try again with a different email address which I have done repeatedly without success. I’m just wondering if you or anyone else on here has experienced the same problem and if so how did you overcome it? Thanks a lot

Regards

Robert

Hello Michael, thanks for this blog. I however have an unresolved issue. I come from a restricted country by Amazon’s categorisation and I want to know if there’s an option for interested people like us to get to sell on Amazon?

register a company in an un-restricted location such as USA or Hong Kong is the best chance – good luck!

Thanks for the response. My next question would then be this: how would I deal with the issue of ID verification, where utility bills and ID cards are normally requested?

wow, this is amazing information …….thanks for sharing here.

I want to start FBA from HK… Just a doubt… Why we need to have payoneer or some other services…. Why Amazon transfers cant be directly wired to my HK business account?…plz reply at amitagar_wal@yahoo.com … as i really wanna kickstart the selling